|

Read the Preservation Alliance of West Virginia's 2021 Annual Report. Check out the .pdf or scroll down to see the report in images.

2 Comments

West Virginians are invited to celebrate their historic preservation success stories through the Preservation Alliance of West Virginia’s new West Virginia Preservation Spotlight series. Submitting a Preservation Spotlight story helps shine a light on the small preservation successes that can add up to significant positive change in a community. Whether it’s a homeowner restoring a historic feature of their house or a business moving into a building on historic Main Street, PAWV wants to hear about preservation “wins” both big and small.

Spotlight stories should involve a West Virginia property listed on the National Register of Historic Places or as a contributing structure to a National Historic District. If you believe your story is relevant despite not meeting this specification (perhaps an event or advocacy success), please email to check with a member of our staff at [email protected]. Submitted Preservation Spotlight stories may be featured on PAWV’s website and social media channels to celebrate the positive steps everyday West Virginians are making towards historic preservation in their communities. PAWV is accepting submissions through a Google form here. A Word document submission form is available for download below. The BRAMWELL FOUNDATION, a nonprofit 501(c)(3) organization, is currently soliciting quotations for the completion of THE PENCE HOTEL STABILIZATION PROJECT grant funded by the PRESERVATION ALLIANCE OF WEST VIRGINIA. This is a historic building project that must follow the Secretary of Interior Standards for Rehabilitation. The Pence Hotel was built around 1911 and is located on Main Street, Bramwell, WV. SCOPE OF WORK NEEDED

STAGE 1: WORK TO BE COMPLETED 1. Conduct a mortar test to determine the composition of the historic mortar and to ensure a close match. Submit a photograph of the sample and historic mortars to the grantor, the Preservation Alliance of West Virginia for approval. Do a test area to ensure the color matches once it dries. 2. Secure and relay loose bricks located above (4) brick arched windows. 3. On the west and south exterior walls, remove and replace all loose brick with brick matching the original as closely as possible 4. Hand rake the existing masonry joints to clean out the remaining mortar and any false work. Re-point all exterior masonry joins, replacing all loose or missing mortar with the approved mortar sample. STAGE 1: APPLICATION PROCESS 1. Secure the area to protect persons & property from any falling debris below the work area(s). Remove any loose brick. Prep work area. Relay of brick in arched pattern consistent with original building structure. Cleanup of areas relating to that project. 2. Either scaffolding or a custom-built workbox to be erected. STAGE 2: WORK TO BE COMPLETED 1. Secure all orifices exposed to outside elements (36 window openings/ 7 doors). 2. Cover window and door openings with appropriate heavy gage plastic to seal from weather. STAGE 2: APPLICATION PROCESSES 1. Attach plastic firmly to current window frames or install temporary framing where necessary. QUALIFICATIONS: The contractor hired must meet the following qualifications: 1. Have performed similar work in the past or be able to prove ability to do work that meets the Secretary of Interior Standards for Rehabilitation. 2. Submit 2 project summaries with references and contact information. 3. Proof of general liability insurance and contractor’s license. 4. Ability to complete PENCE HOTEL STABILIZATION PROJECT by DECEMBER 31, 2022. EXPRESSIONS OF INTEREST: Companies or individuals interested in submitting a bid or quote on the project should submit a detail of costs, project summaries, references, proof of general liability insurance, and a copy of their contractor’s license to the BRAMWELL FOUNDATION, PO BOX 193, BRAMWELL WV 24715. Bids/quotes are due by 12 pm on Saturday, Saturday March 5, 2022. SELECTION PROCESS: THE BRAMWELL FOUNDATION and the grantor, the Preservation Alliance of West Virginia, will review all proposals and select a contractor for the project based on: 1. Experience with similar types of projects, 2. Proven ability to complete a project in a timely manner, and 3. Competitive cost to complete the project. A selection will be made within two weeks and a contract will be worked out immediately with the company. PAYMENT PROCESS: One third (1/3) of the contract amount will be paid the day the work begins, and the remaining two thirds (2/3) will be paid upon satisfactory completion of the project. Further questions regarding the project or for an appointment to access the building contact John Houston 304-248-7382.  ELKINS W.Va. – The Preservation Alliance of West Virginia announces it has joined West Virginia BusinessLink as a Resource Partner available to the state’s small businesses. West Virginia BusinessLink assembles an array of resources in one online destination. “We welcome all Resource Partners to West Virginia BusinessLink,” said Secretary Mitch Carmichael, West Virginia Department of Economic Development. “Our goal is for West Virginia to be competitive as a great place for businesses to locate, start and grow successful. Providing support through resources such as West Virginia BusinessLink and every great Resource Partner helps make that possible.” PAWV services all types of historic building projects and assists all types of building owners such as residential homeowners, commercial developers, and public agencies. PAWV's services include technical assistance and guidance in areas of financing, fundraising, obtaining estimates/bids, and historic preservation in general. PAWV also offers a short-term microloan with a fixed interest rate and competitive grant funding to help bridge the gap in redevelopment projects involving historic buildings. To utilize BusinessLink, West Virginia’s business owners and entrepreneurs can visit wvbusinesslink.com, use the “Connect to Resources” box to find resources in a specific area, explore upcoming training and networking events in the calendar, and find supportive information in the “STARTUP, “GROWTH” and “FUNDING” tabs. In the “Connect to Resources” box, website visitors can answer questions about their company and what they need. BusinessLink analyzes the replies, scours the database of Resource Partners, calculates the best matches and responds to the business owner with referrals. The process of searching for resources and providers becomes faster and more effective. BusinessLink is free to use and available 24/7. One-on-one appointments to discuss business needs can also be requested by calling 888-982-7232. Services available from BusinessLink Resource Partners include the following:

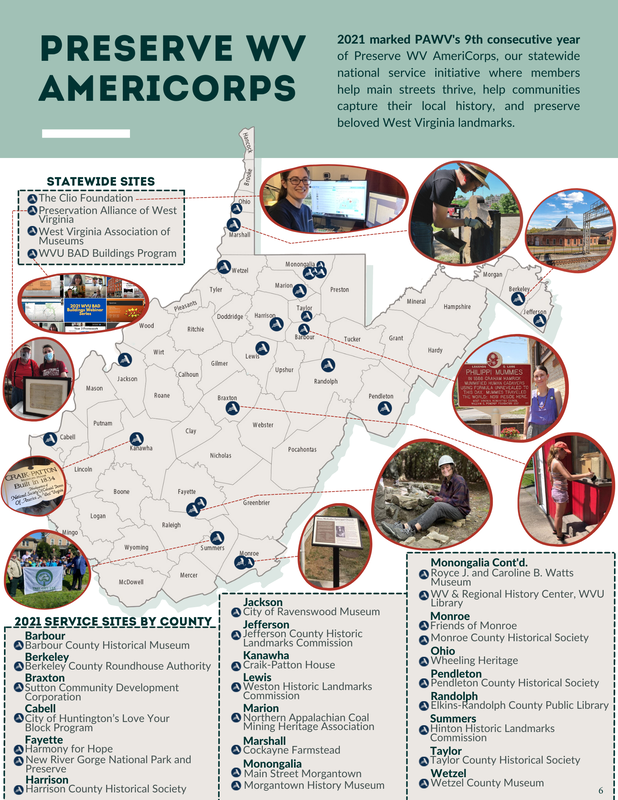

“West Virginia BusinessLink makes it easy to find all the resources a small business owner needs. It connects them with the right resources at the right time,” said Director Debra Martin, WV Small Business Development Center. “Until now, it was difficult and time consuming to determine what agencies and organizations are available to help small business owners and entrepreneurs. We hope BusinessLink resolves this issue and helps position these individuals and their businesses for long term success.” Since 1982, the Preservation Alliance of West Virginia has been working to enhance West Virginia’s Preservation Community in support of our historic structures and landscapes. One of the most effective programs we have deployed to date has been our Preserve WV AmeriCorps program. Since 2013 our AmeriCorps program has deployed 193 AmeriCorps service members across 176 sites in WV. The members have provided services to their sponsoring sites with the goals of increasing capacity, tourism, and sustainability for our historic assets across the state. The benefits of the Preserve WV AmeriCorps program to organizations can hardly be overstated. Beyond the direct service provided by national service members, there have been huge collateral benefits to West Virginia's communities. Service members have gained experience and understanding of the importance and intricacies of preservation activities to help them in their careers, sponsoring organizations have expanded their outreach and capacity to fulfill their missions, and members and alumni throughout the state have been invigorating their communities with fresh ideas and enthusiasm for West Virginia's historic assets. Many Preserve WV AmeriCorps members are from out of state, and some have gone on to remain here and become long-term residents of West Virginia. Recently, the Preservation Alliance completed a Phase One evaluation of its AmeriCorps program with the Indiana University's Eppley Institute for Research. This report found that the 110 Preserve WV AmeriCorps members, who served in the Preserve WV AmeriCorps program during the period 2015-2019, positively impacted West Virginia's communities. Their service directly increased:

A summary of that research is provided in the images below. You can also review a full copy of the report here. Come to Virtual Morning Coffee with the Preservation Alliance of West Virginia, the National Trust Community Investment Corporation, and the National Trust for Historic Preservation.

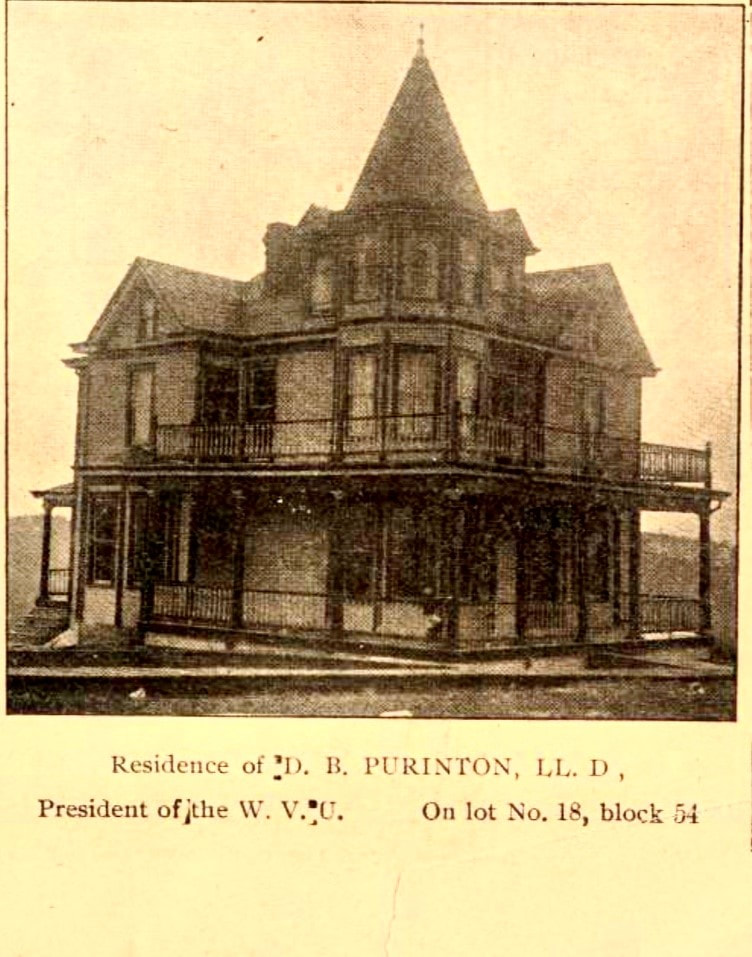

Join us at 9am on Thursday, December 16th, for a news brief where we’ll discuss an opportunity to improve a crucial tool for redeveloping West Virginia’s downtowns and incentivizing the re-use of vacant buildings - the historic tax credit. A total of 122 Federal Historic Tax Credit projects in West Virginia between fiscal year 2001 through 2020 has leveraged an estimated $258,016,381 in total development. During the news brief, we will share a legislative update, how to take action and how potential improvements to the historic tax credit can benefit local community development by maximizing the long-term impact and sustainability of current federal funding opportunities for community projects by incentivizing private sector investment. Register here https://savingplaces-org.zoom.us/meeting/register/tJ0lf-6rrDwsHtUg7nddSrjOJqOE8i9b3ibZ AJ Hammond and Dylan Sheldon, DBA Historic Morgantown, recently completed the historic renovation of the home of former WVU President Daniel Boardman Purinton. The home at 76 Grandview Ave. in South Park, had fallen into a state of disrepair and sat vacant for over a year. However, recognizing the historic significance of the property, Sheldon and Hammond spent the last 18 months renovating the stately home to its original grandeur. “The completion of this project has been incredibly rewarding,” said AJ Hammond, who is a Relationship Banker at Citizens Bank of Morgantown, and the current President of Main Street Morgantown. “The beautiful architecture, the stories behind these properties in South Park and Downtown are what sets this neighborhood apart! Our mission is to preserve these buildings, and share this important history in order to build a more vibrant community and improve the quality of life in Morgantown!” President D.B. Purinton was not the only famed resident of this property. John Alden Purinton, named after his direct descendant John Alden a crew member of the Mayflower, was a son of the President and served as the first Basketball Coach at West Virginia University in 1904. Additionally, Edward Earle Purinton, who was an internationally renowned author and health expert, called this property home. The author’s most popular book selling over 700,000 copies, “Triumph of a Man who Acts,” was distributed to more than 50,000 Officers of the English Army in 1919. “This property was the crown jewel of the neighborhood,” said Dylan Sheldon, a Project Manager at Inneraction Media. “Being a part of the team who brought it back to life, has been an honor.” This project was not Sheldon’s first historic renovation, he also restored an abandoned property on Park Street built in 1926 by carpenter, D.B. Biser. “South Park is a special neighborhood, with important properties,” said Sheldon, “in order to be good stewards of what we’ve been given, it’s important to restore these homes for future generations.” Built in 1907, the Victorian home on Grandview Ave. served as a retirement property for the Purintons. Prior to moving to South Park, the family lived on the campus of WVU in the President’s Mansion. “The Purinton House,” as it is named today, is listed on the National Register of Historic Places and houses the offices of International Students and Scholar Services. The historic renovation features approximately 3,000 square feet of living space, all new electrical, plumbing, roof and windows. This home has been upgraded with modern amenities while preserving the original trim, pocket doors and built-in cabinets. The four bedroom, three bath house will hit the market next week through Nancy Hillegas of Landmark Realty Services.

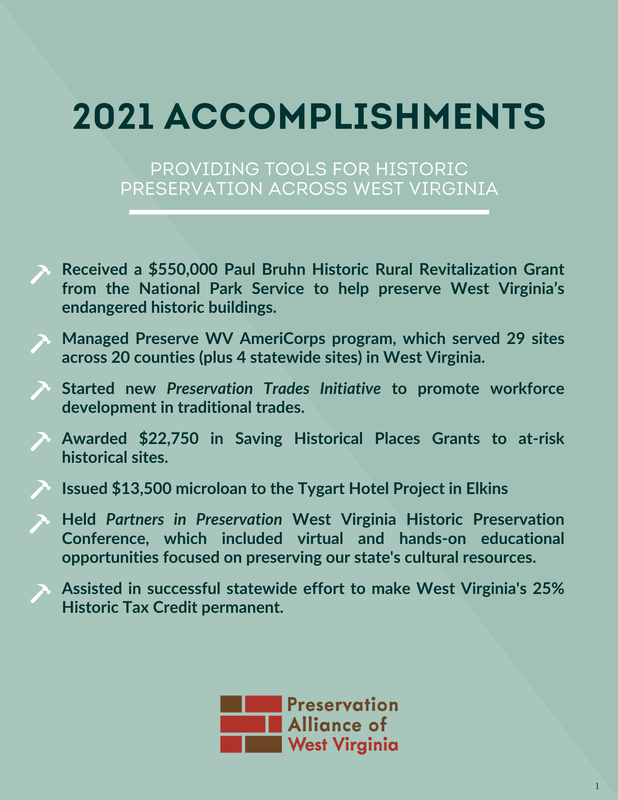

The Preservation Alliance of West Virginia has been awarded a $550,000 Paul Bruhn Historic Revitalization Grant by the National Park Service to help preserve West Virginia’s endangered historic buildings. The Alliance will add this generous grant to its existing Saving Historical Places Grant Program, which provides funding to preserve West Virginia’s historical buildings that have fallen into disrepair and are vacant. Subgrants will be awarded for physical preservation with some opportunities for design assistance from a licensed architect or engineer. “Our goal is to bring more historic buildings back into service and contribute to our sense of place. We want to tell the story of these places through the preservation process,” said Danielle Parker, executive director of the Preservation Alliance. The Alliance is in the process of updating its Saving Historical Places Grant application process and will release formal guidelines explaining more details beginning December 2021 with a January 31, 2022 grant application deadline. The Alliance will present subgrant awards in spring 2022.

The National Park Service announced $7.27 million in Paul Bruhn Historic Revitalization Grants earlier this week. Grants were awarded to 11 recipients with 2 of the recipients in West Virginia. The purpose of this program is to support the preservation of historic buildings in rural communities across the country. This program is provided by the Historic Preservation Fund, as administered by the National Park Service, Department of Interior. For more information about HPF grants and the Paul Bruhn Historic Revitalization Grants program, visit https://go.nps.gov/revitalization.

government agencies, and nonprofit organizations as well as community volunteers and preservation enthusiasts. At the end of the meeting, interested individuals signed up to be a part of a Preservation Trades Task Force that will use action items identified during the meeting to direct our next steps.

The first set of questions discussed were - What historic trade is most in demand? What historic resources are suffering/or are we losing because we don’t have workers? What trades are we losing? From our discussions, we identified five historic trades that are in high demand in West Virginia, but that West Virginia is startlingly lacking in institutional/practical knowledge. These are:

There were also several comments about how it was difficult to find roofing companies to work on slate roofs and that deferred maintenance of smaller problems at our older buildings have led to more expensive repairs, total replacement of historic elements, and unfortunately in many cases, demolition by neglect - meaning that the building has been allowed to deteriorate to the point that demolition becomes necessary or restoration becomes unreasonable. The second set of questions were divided into two separate points. The first being - what are the challenges facing West Virginia’s historic resources in particular? The second question being - what unique opportunities do West Virginia’s historic resources present? Overall, the groups agreed that West Virginia is rich in cultural heritage resources in need of rehabilitation and prime for redevelopment, but we also agreed that retaining and attracting people to West Virginia to live and work in these buildings is one of the biggest challenges our historical towns and cities are facing. Those challenges are further complicated by economic challenges to fund historic preservation projects. Often, the price-tag of a historic structure seems prohibitive compared to the price tag of an entirely new building, and this is compounded by negative attitudes towards historic preservation being costly and complicated in West Virginia. There are also misconceptions that historic buildings cannot be rehabilitated because of hazardous materials such as asbestos or lead-based paint contamination. However, West Virginia has multiple initiatives, including grant funding from the West Virginia Brownfields Assistance Center, to help property owners understand the challenges related to mitigating hazardous materials in their historic buildings. There are also existing regional development agencies that target historic buildings for community-based revitalization projects, and provide support for dealing with these challenges. There is currently an obvious lack of knowledge in the fields of historic preservation trades in much of West Virginia. There is no central trade school or historic preservation technical program in West Virginia to educate our population in these skills, nor is historic preservation being taught at any vocational high school programs. Belmont Technical College is located very close to the northern panhandle of West Virginia in St. Clairsville, OH, and it offers a Building Preservation/Restoration degree program. The groups believe that we can capitalize on this institutional opportunity by encouraging individuals to attend the Belmont Technical College program and using it as a model to develop other preservation training programs in West Virginia. There is also a lack of access to the correct materials needed to rehabilitate many historic buildings or a lack of understanding of how to source materials locally. This lack of access and understanding threatens our infrastructure because construction professionals are trying to repair buildings using incorrect materials that can further degrade the historic structure. The final set of questions revolved around the theme of what can we do to encourage education in historic preservation trades? There is already a respect and value placed on trades skills in West Virginia that works in our favor. Our groups compiled a list of suggestions on the point of how to develop opportunities for people to pursue a preservation trades career. The Preservation Trades Task Force is exploring these suggestions, which included:

The Preservation Trades Task Force is already working on some of these action items and will be meeting monthly to discuss our projects. If you are interested in joining the Preservation Trades Task Force or for more information, contact PAWV executive director, Danielle Parker at [email protected]. West Virginia has made its historic tax rehabilitation credit program permanent. Gov. Jim Justice recently signed the bi-partisan bill, which provides a 25% tax credit for those who rehabilitate historic income-producing properties. The 25% credit, which became law in 2018, was set to expire at the end of 2022. In those five years, the program attracted renewed interest in West Virginia’s historic commercial districts and spurred private reinvestment in more than 80 vacant and dilapidated buildings throughout the state. In just two of those years, more than $34 million were invested in nine projects. The move to a permanent 25% credit provides needed certainty to property owners and developers, explained Renee Kuhlman, Senior Director at the National Trust for Historic Preservation. The 25% credit often fills a financing gap in a project, but the uncertainty around its future made it difficult for developers to successfully apply for construction loans or plan long-term projects. “The removal of the sunset date increases the attractiveness of the credit to investors,” Kuhlman said. “Already, I’ve received a call from a New Orleans developer wanting information about West Virginia properties because the program was made permanent.” Without this tax credit, many historic redevelopment projects would not happen, explained Danielle Parker, executive director of the Preservation Alliance of West Virginia, a statewide organization dedicated to supporting and promoting historic preservation. The 25% credit is often the reason a project becomes feasible. "There are over 1,000 properties, including 168 historic districts, that can be revitalized using the credit, and I am excited to see how these places can be brought back to life using this financial incentive,” Parker said. The state historic tax credit is capped at $30 million of income tax credits per year. The program also offers a 20% residential rehabilitation credit for historic homes, which is also permanent. The State Historic Tax Credit is administered by the WV Historic Preservation Office, and the National Parks Service. For more information on applying for the credit or to find out if your property is an eligible tax credit project, please call 304-558-0240. You can also Visit the WV Historic Preservation Office's website for additional information. THANK YOU!Thank you to Senator Ryan Weld for being the original sponsor of this legislation and for being a champion of historic preservation and community revitalization for West Virginia!

We want to say thank you to the legislation's co-sponsors too! They are Senators Mike Woelfel, Robert Plymale, Richard Lindsay, Eric Nelson, Stephen Baldwin, Mike Maroney, and Glenn Jeffries. Special thanks to Delegate Erikka Storch for supporting this bill through the House of Delegates and to the Abandoned Properties Coalition for leading the charge to make the 25% state historic tax credit permanent. |

News and NotesCategories

All

Archives

May 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: [email protected] Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed