|

By Lynn Stasick, Statewide Field Representative

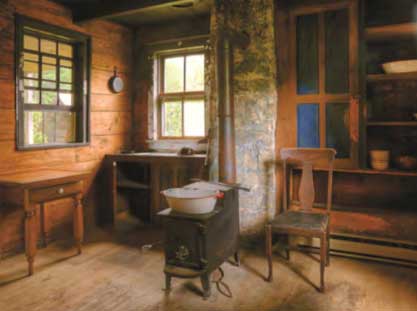

I had seen pictures of the Ananias Pitsenbarger farm, but a recent visit met all of the expectations the pictures had promised and more. Located in Pendleton County near Franklin, this beautiful farmstead is nestled into gently sloping hillsides rising to the surrounding mountains. Established circa 1845, the site presently consists of twenty-six extant log structures including the original house. I visited with the owners and stewards of the property, Teresa and Jeff Munn in their newer log home perched on a hillside overlooking the original buildings. In speaking with them, it immediately became obvious that these people are very dedicated, not only to the past history of the site and its people but to carefully preserving the structures. One such effort which is underway is to make the original home habitable once again for use as a guest house. In addition, several of the outbuildings have foundation problems which they are addressing this spring. In addition to a beautiful farm, the Munns are delightful people. After viewing photos of the Pitsenbarger family, a book on the area, and a discussion as to what my role as field representative is and what we hoped to accomplish that day, we took a walk to examine the buildings and discuss their structural issues. Afterward, my traveling companion and Elkins historian Deborah Farrell and I were treated to a wonderful Italian dinner followed by an apple crisp dessert. It was delicious. I would like to offer a word of thanks to Jeff and Teresa for their kind hospitality as well as to their tireless dedication to preservation. Our hats are off to you. For more information on the farm, visit http://www.pawv.org/endangered2013/farmONEweb.pdf To learn about all the 2013 WV Endangered Properties, visit http://www.pawv.org/endangedlist2013.htm The Residential Historic Rehabilitation Tax Credit has assisted homeowners throughout West Virginia to repair, retain, and improve quality housing for families of all income levels. The purpose of the credit is to provide the needed incentive to repair older homes (including condos) listed individually or in a National Register historic district and to help individual homeowners afford this material rehabilitation. It also encourages work that meets the “Secretary of the Interior’s Standards for Rehabilitation and Guidelines for Rehabilitating Historic Buildings” by providing a 20% tax credit for qualifying expenditures including roof, window, and siding replacement and the upgrade of heating systems.

If HB 2916 and SB 436 are passed, this tax credit would be eliminated beginning July 1, 2013. UPDATES ~ Currently both bills are in committees with HB 2916 in the House Finance Committee (http://www.legis.state.wv.us/committees/house/HouseCommittee.cfm?Chart=fin) and SB 436 in the Senate Government Organization Committee (http://www.legis.state.wv.us/committees/senate/SenateCommittee.cfm?Chart=govo). Neither of the bills have been added to the agenda of the respective committees, and the bills must be out of committees by March 31st to ensure three full days of readings – which means that if the bills do not leave their respective committees by March 31, the bills have no chance of being passed into law this session. You can contact the respective committee members, at the above links, to show your support for the tax credit. Why is the residential tax credit so important?

Although the bills are not up for vote yet, you can still make your voice heard by contacting your State Delegates and Senators to make them aware of this threat. You can show them your support for the tax credit by asking them to vote NO to HB 2916 or SB 436 if they are to come up in this session. You can call their office, send emails, or faxes. Contact information for state senators is here: http://www.legis.state.wv.us/Senate1/roster.cfm Contact information for state delegates is here: http://www.legis.state.wv.us/House/roster.cfm By William “Skip” Deegans, Lewisburg Historic Landmarks Commission Many Greenbrier Countians have stepped inside “The Westly,” but few, if any, knew it had a history until Rose Thornton saw it. Thornton, a nationally-recognized expert on kit homes, immediately realized it was an early version of a Sears Roebuck home known as The Westly. Most locals knew it only as the West Virginia University Extension Office. The house was built about 1925 and was bought by the Greenbrier County Court in 1941. After the county purchased it, the house continued as a residence until it was converted into an office for the extension service. A few years ago it was vacated and has quickly deteriorated because of neglect. The house is located next to the county courthouse and a proposed expansion of the courthouse would have caused the house to be razed. Last year, the Lewisburg Historic Landmarks Commission (LHLC) served as an intermediary with the President of the County Commission and a local realtor to move the house to a lot about a block away. Since then, the commissioners have shifted their thinking around to preserving and using the house for offices for a county program and moving the courthouse expansion to the rear instead of the side.

Fortunately, The Westly is much like it was when it was first erected. Even though it was used as offices for much of its life, the floor plan has changed very little. All of the original interior woodwork, including lovely double doors and hardwood floors, are intact. All of the windows are believed to be original. The most immediate needs of the house include new asphalt shingles on the roof and painting. The LHLC has encouraged the county to submit an application to WV State Historic Preservation Office for a matching grant to make these repairs. While Lewisburg is well known for its large colonial and Victorian homes, The Westly represents an important post-WWI period in Lewisburg’s history when companies like Sears Roebuck, Montgomery Ward, and Aladdin offered folks an affordable well-designed home built of quality materials. For more information about “The Westly” check out Rose’s great article: http://www.searshomes.org/index.php/2013/03/03/save-the-westly-in-lewisburg-wv/ For more information on the 2013 WV Endangered Properties, visit http://pawv.org/endangedlist2013.htm. Many industrial construction projects require cultural surveys for locating cemeteries, battlefields, and other historic and prehistoric sites before beginning work. Cultural surveys are typically required as part of federal and state permitting and licensing processes. This is to protect such places from being inadvertently desecrated during highway construction, coal production, wind farm construction, and natural gas production and transmission. Despite this seemingly obvious concept, cultural surveys are not required for non-jurisdictional gathering lines used in the transportation of natural gas.

–>What is a Cultural Survey? A cultural survey is a search executed by a trained professional, i.e. an archaeologist, to make sure that construction plans avoid culturally significant resources like cemeteries, churches and other historically and culturally significant sites. –>What Does this Bill Do?

–>What is a Non-jurisdictional Gathering Line? A gathering line generally runs from the gas well to a processing plant or larger transmission line. Pipelines that perform a gathering function are exempt from FERC regulation under the Natural Gas Act of 1938. The WV Public Service Commission, in cooperation with the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration, regulates approximately 555 miles of Class II, Class III, and Class IV gathering lines in West Virginia for safety. Class I gathering lines are most common in rural areas and are not regulated by WVPSC/PHMSA. Such lines are generally referred to as “non-jurisdictional gathering lines” as they are not regulated by any state or federal agency. Since they are not issued permits, licenses, or approval by a state or federal agency, such pipeline construction projects are not currently required to conduct cultural surveys prior to construction. –>Why is this Bill Important? West Virginia’s history is as dynamic as its landscape, as is evident by the wealth of rural cemeteries, graves, and other historic sites. SHPO records the presence of cemeteries, but only when reported by the public. Many go unreported and remain absent from the state’s records and maps. Also, many rural cemeteries and graves have a variety of markers in addition to the typical modern headstone, necessitating the need for a trained professional to recognize their presence to assure proper identification. This bill not only extends protection to the remains of West Virginian descendants, but helps preserve our state’s rich heritage for future generations. Show your support for HB 2893 by contacting your State Delegates. Contact information for Delegates is available at http://www.legis.state.wv.us/house/roster.cfm The West Virginia Historic Preservation Tax Credit Program offers a 20% tax credit on allowable expenditures like roof repair and window restoration. Privately-owned homes listed in the National Register of Historic Places and those listed in National Register historic districts are able to receive this tax credit. This very effective program is in jeopardy as bills are being fast-tracked through the State Senate and House of Delegates to repeal this tax credit.

Please show your support for historic preservation and this tax credit program by contacting your state Senators and Delegates and ask them to VOTE NO to the following bills: HB 2916 for the House of Delegates Bill, http://legiscan.com/WV/text/HB2916/id/784966 SB 436 for the State Senate. http://www.legis.state.wv.us/Bill_Text_HTML/2013_SESSIONS/RS/Bills/sb436%20intr.htm Many have already been contacting their Delegates asking them to Vote NO to HB 2916. We appreciate this support and ask that you do the same for the SB 436. To find your State Delegates by District, follow this link: http://www.sos.wv.gov/elections/currentelection/districts/Pages/Districts_Delegate.aspx To find your State Senators by District, follow this link: http://www.sos.wv.gov/elections/currentelection/districts/Pages/Districts_Senatorial.aspx For contact information for your State Delegates and Senators, visit: http://www.legis.state.wv.us/house/roster.cfm http://www.legis.state.wv.us/Senate1/roster.cfm We also ask that you contact the President of the Senate, Jeffrey Kessler, asking him to vote NO to SB 436. His contact information is [email protected]. His Phone Number is (304) 357-7801. You can also show your support for the residential tax credit by contacting the Speaker of the House Richard Thompson at [email protected] Please help us to protect this tax credit, which creates opportunities for investment in our downtowns, saves our historic neighborhoods, and preserves our vast heritage. Without it, historic districts like South Park in Morgantown, Luna Park in Charleston, and the Wees District in Elkins would not exist. For more information, contact [email protected]. Preservation Alliance of West Virginia is accepting nominations for the 2013 West Virginia Historic Preservation Awards. The annual Historic Preservation Awards banquet will be held at the Hotel Morgan in Morgantown, WV on Saturday, September 21, 2013. All are welcome to submit nominations and attend the banquet.

Visit http://www.pawv.org/update.htm for downloadable nomination forms and guidelines. All nominations are due May 15th, 2013. Please submit your nomination via email to [email protected]. As the statewide non-profit organization supporting historic preservation in West Virginia, we have received many calls of concern about the rising natural gas wells, pipelines, and drilling and the disregard for family cemeteries during these projects. Until recently, the only advice that I could give to these folks is to contact the WV State Historic Preservation Office (WVSHPO) and complete a Cemetery Survey Form. http://www.wvculture.org/shpo/cemeteries.html Once the cemetery survey form is completed, at least the WVSHPO would have a record of the cemetery, and if a Section 106 review was necessary for a natural gas project, your cemetery would be considered in this project.

We are, hopefully, on our way to having greater protection for family cemeteries! On Monday, March 11, 2013, Delegates Manypenny, Marshall, Moore, Wells, Caputo, Longstreth and Fleischauer introduced HB 2893 – a bill that would require cultural surveys to be performed before any natural gas project, as well as prohibit natural gas pipelines, wells and associated facilities from being constructed within one hundred feet of a cemetery or grave site. Preservation Alliance sees this as a huge step towards protection of our historic resources. Please take a moment with us to contact your state legislator, and show your support for HB 2893. Also, don’t forget to thank the sponsoring Delegates for their support of historic preservation and the protection of family cemeteries. By Lynn Stasick, Preservation Alliance Statewide Field Representative

Oftentimes, when devastating events such as fires occur, what to do and where to turn can be both overwhelming and daunting for the stewards of historic properties. It is important to remember however, that the restoration, preservation, and adaptive re-use of a building should be viewed as a series of inter-connected baby-steps taken one step at a time. This helps to calm the spirit and clear the head, which aids in moving toward the project’s completion. In my capacity as Field Representative, I met with Tom and Margaret to survey the house and open up a discussion as to their plans for saving the building. It was then that they expressed the need for some guidance. Through further discussion, we agreed that I would act through PAWV as an agent on their behalf in an effort to gather estimates to have repairs made. In the past months I have done so. Although it is PAWV’s mission to help with the saving of West Virginia’s historic properties, it is always refreshing to receive a message like the Feasters sent in thanks for our efforts. “A note to express our appreciation for your assistance in the Abruzzino Mansion project. . . . The situation was completely overwhelming for us. . . . Without your assistance we would still be wondering where to start. . . .You have taken the lead in starting the job and got it moving while we were still thinking about it. . . . As it is now, the electricity has been re-connected and we have bids to seal the roof.” It is true that projects such as this take other people’s input and expertise. However, a voice of thanks should be given to the Feasters and others like them for their dedication to preserving West Virginia’s precious heritage sites not only for our enjoyment and edification, but that of generations to come.

For more information on the 2013 WV Endangered Properties, visit http://pawv.org/endangedlist2013.htm. |

News and NotesCategories

All

Archives

May 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: [email protected] Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed