|

Last week, the West Virginia Legislature passed legislation that improves the 25% State Historic Tax Credit (HTC) in West Virginia, and it is now on its way to the Governor's desk.

House Bill 4568 (known as Phased Rehabilitations of Certified Historic Structures) achieves multiple goals such as:

If signed into law by Governor Justice, this legislation will become effective on July 1, 2022. What this means for West Virginia is that completing HTC projects just got a little simpler. The three-part application for the state and federal HTCs (which when combined total 45%) will be a more fluid process when working with the West Virginia State Historic Preservation Office and the National Park Service because the agencies will now follow the same procedural rules, thus minimizing paperwork requirements. Equally as important, removing the limitations on allocations and guarantees of historic tax credits will make it more secure and improve investor confidence when undertaking both larger and smaller projects. This is a major win for West Virginia! These provisions increase the Mountain State’s attractiveness from industry-based development firms that specialize in HTC-backed projects, in addition to making the program more user-friendly for individuals wanting to undertake smaller projects. Neighboring states have more restrictive programs, making West Virginia a very investor-friendly state for HTC projects in the mid-Atlantic region. For instance, Maryland has a 20% state HTC that is capped at $3 million per project with a $9 million annual cumulative cap per fiscal year. Pennsylvania and Ohio both have a 25% state HTC, but they have $5 million annual cumulative cap per fiscal year. HB 4568 was sponsored by Delegates Jason Barrett (R-61), Eric Householder (R-64), Erikka Storch (R-03), Vernon Criss (R-10), Paul Espinosa (R-66), Daniel Linville (R-16), Joe Ellington (R-27), Ruth Rowan (R-57), Clay Riley (R-48), Dianna Graves (R-38), and John Hardy (R-63). The Alliance appreciates their support and would also like to thank the leadership and policy expertise provided by the Abandoned Properties Coalition and their long-term dedication to seeing West Virginia’s state historic tax credit improved. The Preservation Alliance of West Virginia is the statewide, grassroots nonprofit dedicated to historic preservation. The Alliance has been working as a member of the Abandoned Properties Coalition since 2016 to improve the state HTC to include the provisions outlined in HB 4568. For inquiries regarding usage of the West Virginia commercial HTC, contact the West Virginia State Historic Preservation Office’s Tax Credit Coordinator, Meredith Dreistadt at [email protected].

2 Comments

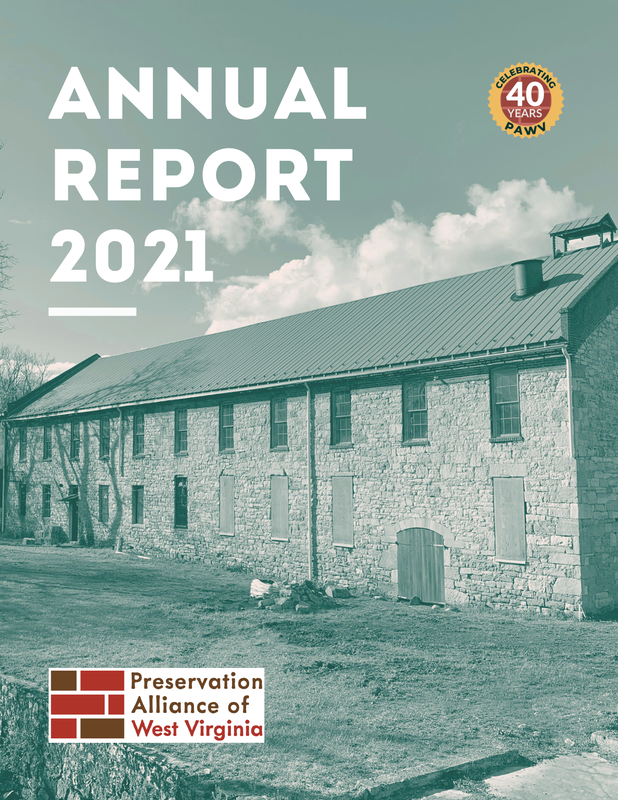

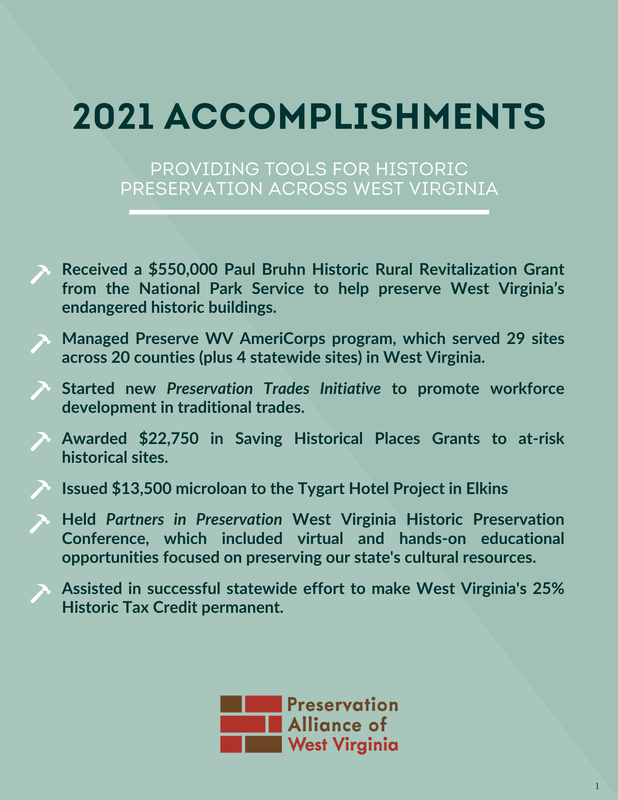

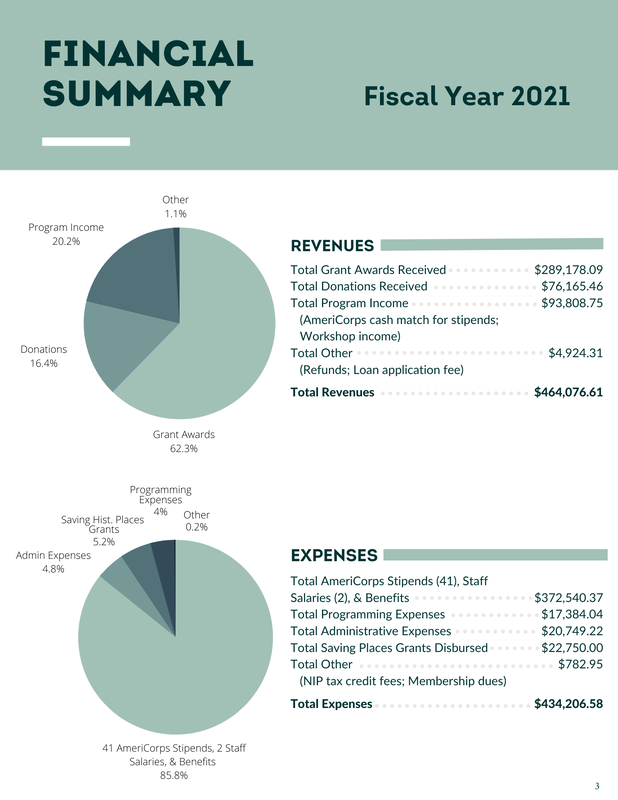

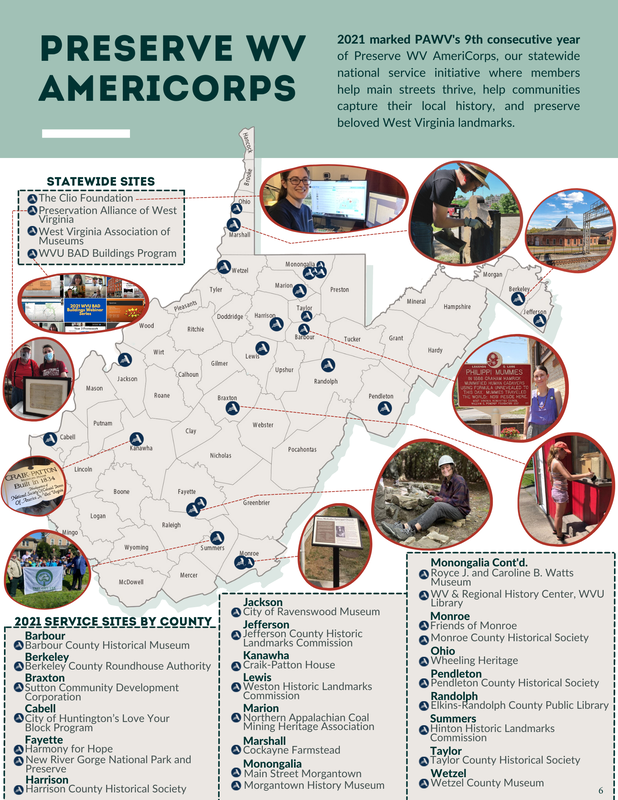

Read the Preservation Alliance of West Virginia's 2021 Annual Report. Check out the .pdf or scroll down to see the report in images.

|

News and NotesCategories

All

Archives

May 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: [email protected] Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed