|

By Nicole Marrocco / WV Community Development Hub

Little excites me more than a community finding a modern use for a historic building. Nerdy, I know. But just check out this church turned indoor rock gym, gas station turned restaurant, and bank turned grocery store, and I guarantee you’ll be geeking out over the untapped potential of abandoned and underperforming historic buildings alongside me. Historic tax credits make it possible to revitalize historic properties that have a financing gap between what banks will lend and the total cost of rehabilitation. Developers restoring income-producing (i.e. commercial, industrial, agricultural, or rental-residential) buildings listed on the National Register of Historic Places or certified by the National Parks Service can apply for personal or corporate net income tax credits from West Virginia worth 10 percent of rehabilitation expenses. Unfortunately, West Virginia’s 10 percent rate just isn’t cutting it — especially considering all of our neighboring states have either a 20 or 25 percent historic tax credit rate. Developers are wary of rehabbing buildings here because the risk is so much higher compared to places just across the state border. Over the last few months, the Revitalize West Virginia’s Downtowns Coalition (including Generation West Virginia) has been advocating to increase the rate to 25 percent to make our state’s historic districts more attractive to developers and spur private investment. Read the full UpThink to find out why — as a young person living in West Virginia — I believe an increased historic tax credit rate is a game-changer. By Joselyn King / The Intelligencer

WHEELING — The West Virginia House of Delegates passed its version of a revenue bill Friday on what was the sixth day of a special legislative session in Charleston called for setting the state’s 2018 budget. Despite a long agenda of proposed amendments, House Bill 107 was approved with few changes from the measure passed Thursday by the House Finance Committee. It would maintain West Virginia’s consumer sales tax at 6 percent, but would eliminate sales tax exemptions on cellphone services. It also would make no changes to the state’s coal and gas severance tax rates, but would gradually eliminate all taxation of Social Security within the next three years. Read the full story, including more about the historic tax credit, at theintelligencer.net. By Ashton Marra / WV Public Broadcasting

Members of the House are standing their ground when it comes to tax reform. At least, that’s what House Speaker Tim Armstead said Friday after a vote in the chamber on its own version of a revenue bill. The bill does not include any of the changes to the personal income tax Senate Republicans and Gov. Jim Justice have agreed to, but Armstead said that doesn’t mean his chamber isn’t still willing to work on a compromise. Members of the House voted 74 to 17 in favor of the tax bill negotiated between House Democrats and Republicans. It brings in an estimated $100 million in additional revenue to close a budget gap in the 2018 fiscal year, which isn’t enough according to members of the chamber, but is a start. Read the full story, including more about the historic tax credit, at wvpublic.org. Although the main order of business is to pass a budget, Governor Jim Justice has made it a priority to also include increasing the state’s historic tax credit to the agenda, and we’re really excited about it.

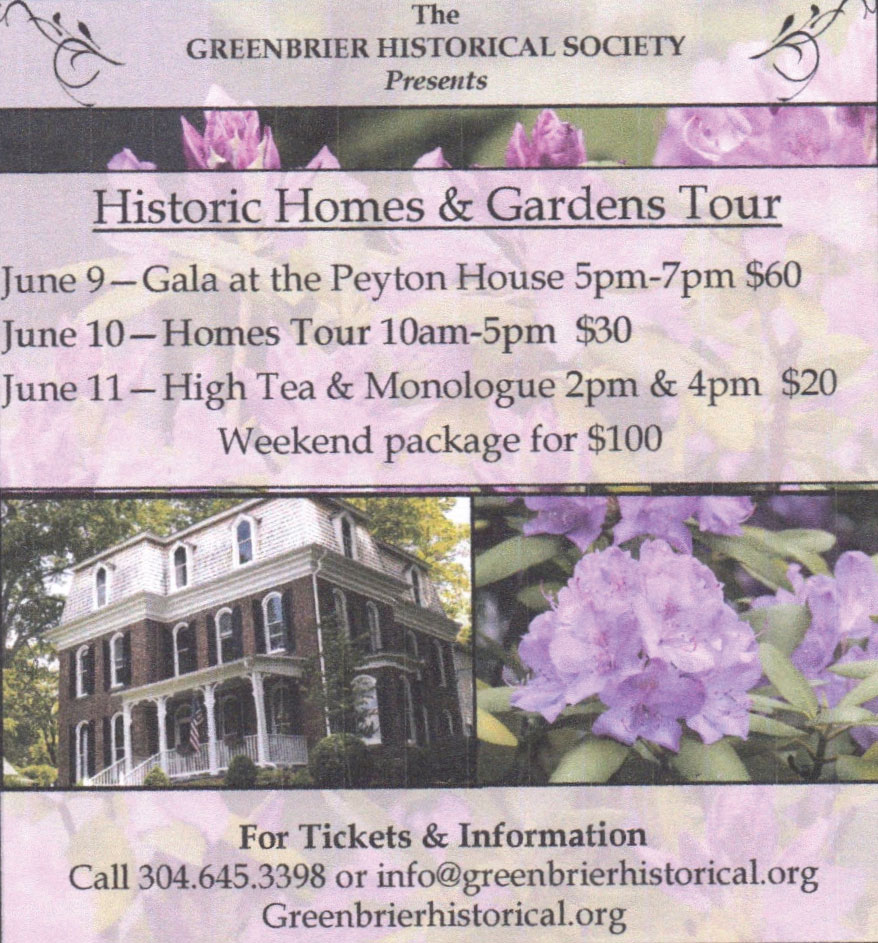

Increasing the state’s historic tax credit to 25 percent will help spark new development in West Virginia’s historic downtowns. As the statewide organization dedicated to attracting and retaining young people in the Mountain State, we know that quality of place is a driving factor for young people in choosing where they want to live and work. Young people want to be where the action is and an increase in historic tax credit will help West Virginia build walkable, vibrant communities that are especially attractive to the next generation. Check out the special session update from Generation West Virginia. After receiving widespread bipartisan support during the regular session, historic tax credit legislation ultimately failed on the final day of regular session. But now we have another chance to increase the state’s historic tax credit, and we need your help to do it. If revitalizing your downtown is a priority to you, let your representatives know by clicking here. The 2017 Homes Tour weekend of June 9, 10, and 11, 2017 will have some amazing opportunities for our guests. On Friday night, our Gala will be at the new home of Angus Peyton. His hill top eyrie provides magnificent views to the far away mountains and cool breezes across the patios. Ticket holders will enjoy both as well as wine and hors d’oeuvres.

On Saturday, the traditional tour of homes will include a former girls dormitory, now a stately home; a former art gallery that retains its graciousness; a home that has survived war and floods and still welcomes visitors; and the Presidents’ House Museum at the Greenbrier as well as another historic cottage if available. On Sunday, St. Thomas Episcopal Church in White Sulphur Springs will welcome guests to its historic sanctuary for two separate sessions (2:00 p.m. and 4:00 p.m.), to view folk art paintings and have afternoon tea. A special presentation by Neely Seams portraying Medal of Freedom winner Katherine Johnson will offer insight into her life in White Sulphur Springs and beyond. |

News and NotesCategories

All

Archives

May 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: [email protected] Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed