|

Come to Virtual Morning Coffee with the Preservation Alliance of West Virginia, the National Trust Community Investment Corporation, and the National Trust for Historic Preservation.

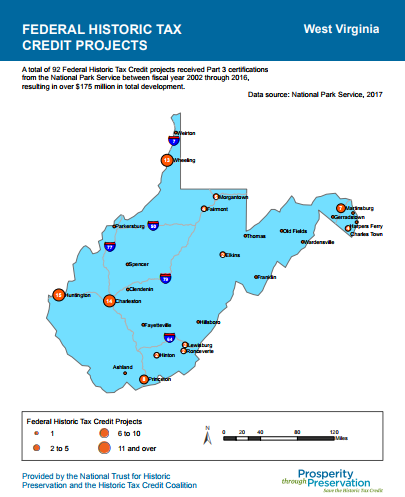

Join us at 9am on Thursday, December 16th, for a news brief where we’ll discuss an opportunity to improve a crucial tool for redeveloping West Virginia’s downtowns and incentivizing the re-use of vacant buildings - the historic tax credit. A total of 122 Federal Historic Tax Credit projects in West Virginia between fiscal year 2001 through 2020 has leveraged an estimated $258,016,381 in total development. During the news brief, we will share a legislative update, how to take action and how potential improvements to the historic tax credit can benefit local community development by maximizing the long-term impact and sustainability of current federal funding opportunities for community projects by incentivizing private sector investment. Register here https://savingplaces-org.zoom.us/meeting/register/tJ0lf-6rrDwsHtUg7nddSrjOJqOE8i9b3ibZ

1 Comment

We're pleased to share that the 20 percent federal historic tax credit (HTC) was retained in the final tax reform bill. Keeping the federal historic tax credit as a permanent part of the tax code is a significant victory for the historic preservation community—especially considering that the first House version eliminated the credit.

We owe this success to the thousands of advocates who rose to the occasion and made your voices heard, as well as to the leadership of key members of Congress. We are particularly grateful to Representatives David McKinley (R-WV) for exhibiting strong leadership during this process. On Friday, December 15, House and Senate conference committee members reached agreement on the details of major tax legislation that will now proceed to a final vote in both chambers this week. The agreed-upon version keeps the historic tax credit at 20 percent but requires that the credit be taken over five years instead of all at once. The legislation repeals the 10 percent rehabilitation tax credit for non-historic buildings, but it does retain the New Markets Tax Credit.

Inclusion of the historic tax credit in the most significant tax legislation to move through Congress in more than three decades is an exceptional reaffirmation that rehabilitation of historic buildings is sound federal policy and good for the nation. While several steps remain before the Tax Cuts and Jobs Act (H.R. 1) becomes law, please take a moment to reflect on what a significant accomplishment retention of the historic tax credit is for the preservation movement and for the betterment of our communities. With the recent increase in the state historic tax credit to 25%, West Virginians will have access to 45% in combined state and federal tax credits when undertaking construction on a historic income-producing property. The 25% increase takes effect on January 1, 2018. Thank you to the many preservationists, practitioners, and stakeholders who worked countless hours to ensure this critical preservation tool remains a pillar of federal historic preservation policy. Thank you to Congressmen McKinley and Jenkins for standing up to retain the historic tax credit and signing a Tax Credit letter focused on the Historic Tax Credit and New Markets Tax Credit. You can thank Congressman McKinley through his website at https://mckinley.house.gov/email-me/. He has been instrumental in leading the effort to save the historic tax credit. You can thank Congressman Jenkins through his website at evanjenkins.house.gov/contact/email. Urgent Action Needed: Advocate for a 20% HTC in Final House/Senate Reconciled BillEarly on Saturday morning, the United States Senate passed its tax reform bill on a vote of 51-49, moving the legislation to a House and Senate Conference Committee to reconcile the two versions of tax reform. The Senate bill restores the 20% Historic Tax Credit (HTC) with a provision that it will be claimed over five years.

Your immediate ACTION is needed! All advocates should be fully activated across the country, connecting with both House and Senate offices. Call-to-Action: Call (during office hours) the offices of your Members of Congress. Ask to speak to tax staff, your staff contacts in offices or ask for email addresses of tax staff. Scroll down for contact information and suggested messages: 1. Introduce Yourself as a Constituent Contact info: McKinley, David - (R - WV, 1) (202) 225-4172 https://mckinley.house.gov/contact/ Suggested thank you: "I would like to thank the Congressman for his leadership during the tax reform bill and for his efforts to preserve the 20% Federal historic tax credit. We hope the Congressman will continue to fight for this important financial development tool during House and Senate conference committees related to the tax reform bill." Mooney, Alex - (R - WV, 2) (202) 225-2711 https://mooney.house.gov/contact Jenkins, Evan - (R - WV, 3) (202) 225-3452 Contact: https://evanjenkins.house.gov/contact Suggested Message to Congressmen Mooney & Jenkins: I am calling to request your help to ensure the existing federal historic tax credit (HTC) is retained through the tax reform process. The House tax reform bill repeals the HTC, but the Senate Finance Committee is proposing to keep the historic tax credit in place with certain reductions to the incentive. We need the HTC retained at its current level of effectiveness so that this proven tool can continue to restore under-utilized buildings, create local jobs and revitalize older commercial districts. 2. Explain why you value Historic Tax Credits, and that the redevelopment of historic buildings will not get done without the HTC. 3. Let them know some previous and future HTC projects in your state/district 4. Touch on why these historic buildings are so challenging but important to our communities. 5. If your Member of Congress has agreed to help, please remember to thank them and tell others about their support! SENATORS: Contact info: Manchin, Joseph - (R - WV) 202-224-3954 https://www.manchin.senate.gov/contact-joe Capito, Shelley Moore - (R - WV) (202) 224-6472 Contact: www.capito.senate.gov/contact/contact-shelley Suggested thank you - “I would like to thank the Senator for supporting a tax reform bill that includes a 20% Historic Tax Credit in Senate tax reform bill. This is a significant improvement compared to the elimination in the House bill. Please communicate to Senate Republican Leaders and Chairman Hatch (R-UT) that they must not weaken important protections for the Historic Tax Credit when they reconcile the House and Senate bills.” It is extremely important to keep all Capitol Hill communication constructive and respectful. Background In November, Senate Finance Committee legislation eliminated the pre-1936 10% non-historic “old-building” credit and reduced the 20% HTC to 10%. HTC advocates were successful in working with Senator Cassidy (R-LA), and other Finance Committee Senators, to support a provision to restore the HTC to 20% for historic buildings. As a cost saving measure, the “Cassidy Amendment” provided that the 20% credit will be released over the 5-year compliance/recapture period (or 4% per year). The Finance Committee approved the provision, which was included in a Manager’s Amendment, on a party line vote. The House passed a tax reform bill on November 16th. The House version of the bill eliminates both the 10% pre-1936 non-historic “old building” credit and the 20% HTC. With House Republicans highly motivated for a legislative win, few Republicans voted against the bill. Next Steps House members will still have an opportunity to voice their continuing support of the HTC when the House and Senate negotiate the final tax package. Many House members and supporters of the HTC have encouraged House Leadership to accept the improvements in the Senate bill and advocates are encouraged THIS WEEK to continue sending this message to their Members of Congress. While advocates are disappointed they could not fully restore the 20% HTC to current law and prevent the elimination of the 10% pre-1936 rehabilitation credit, they are standing their ground, insisting on the Senate provision and that no further erosion takes place. Urgent Action Requested! The federal historic tax credit reduced in Senate Tax Reform Bill Release, House Committee Passes Tax Bill with HTC Eliminated Today the Senate Finance Committee released their version of a tax reform bill that reduces the Historic Tax Credit in half, from 20% to 10% for historic buildings. Additionally, the 10% pre-1936 non-historic “old” building credit is eliminated. Also today, the House Ways and Means Committee passed The Tax Cuts and Jobs Act (TCJA) or H.R. 1, with the HTC entirely eliminated, on a party line vote 24-16, setting up full-House floor consideration next week. Your immediate ACTION is needed! Advocacy Resources

How Can You Take Action? Contact House and Senate Members - Call (during office hours) the offices of your Members of Congress. Ask to speak to tax staff, your staff contacts in offices or ask for email addresses of tax staff. A suggested outline of your email message or phone call:

All advocates should be fully activated across the country, connecting with both House and Senate offices, asking them to retain the HTC in tax reform bills, undiminished. The fate of the HTC will be determined over the next few weeks, please advocate and ask others to advocate!

The House of Representatives is expected to consider and vote on the bill on the House floor next week. Also next week, the Senate will begin to mark-up and pass their version of the tax reform bill out of the Senate Finance Committee. -Please contact your House Representative by COB Monday and ask them to work with House leadership to insert the HTC back into the final House bill. -Contact your Senators by COB Monday and ask them to go to the Senate Finance Committee and Senate leadership, express support to retain the HTC in the Senate tax reform bill undiminished. Despite our collective frustrations, it is extremely important to keep all Capitol Hill communication constructive and respectful. Advocates Should Focus on Preserving the HTC not influencing the Transition Rules While the House repeal transition rules have been described as both stingy and unclear, advocates should direct 100% of their advocacy to preserving the credit in its current form in the House and Senate. Should the need arise, there will be opportunities later in the legislative process to negotiate favorable transition rules. Now is not that time. Such actions could extinguish momentum advocates are gaining to retain the HTC in tax reform. There is a good chance the Senate bill passed out of committee will incorporate the historic tax credit and there is still opportunity for the HTC to be added back in the House bill.

U.S. Representatives Evan Jenkins, R-W.Va., and David McKinley, R-W.Va., have been outspoken in their support for the credits, she said.

"We are grateful that McKinley and Jenkins requested the inclusion of this economic-development tool in the tax reform bill," LaPresta said. "Both legislators represent districts in which historic tax credits are attracting private investment." Historic tax credits helped finance 92 commercial-rehabilitation projects in West Virginia between 2002 and 2016, leveraging more than $175 million in development investment and supporting more than 3,500 construction jobs, she said. "These credits are highly influential when it comes to attracting larger businesses into West Virginia downtowns," LaPresta said. The tax credit was championed by President Ronald Reagan to encourage the rehabilitation of abandoned and underutilized properties. Since 1981, it has leveraged more than $131 billion in private investment and created more than 2.4 million, she said. The state Legislature in October increased the State Historic Tax Credit from 10 to 25 percent, but weakening or eliminating the Federal Historic Tax Credit could endanger the feasibility of nearly all historic rehabilitation projects in West Virginia. "We think the credit complements, rather than hinders, Congress's goal of pro-growth tax reform," LaPresta said. “There are a dozen buildings that we predicted would be rehabilitated with the increase of the state historic tax credit. Now, with the proposed elimination of the federal credit, we fear progress will be jeopardized." The Preservation Alliance of West Virginia is a non-profit dedicated to historic preservation and a statewide partner in the National Trust for Historic Preservation. LaPresta is urging business leaders who wish to advocate for the federal historic tax credit to contact the alliance at 304-345-6005 or visit its website at PAWV.org. MEDIA CONTACT Danielle LaPresta Executive Director Preservation Alliance of West Virginia www.pawv.org [email protected] 304-345-6005 This is not a drill! Last week the Republican Congressional leadership and the Administration released the Tax Reform Framework, which did NOT include the federal historic rehabilitation tax credit. The tax reform outline does, however, explicitly preserve business credits in two areas where leaders believe tax incentives have proven effective: research and development (R&D) and low-income housing. This suggests there is an opportunity for action. It’s remarkable how the historic tax credit has positively impacted community economies across West Virginia. Between 2002 and 2016 the historic rehabilitation tax credit has leveraged nearly $175 million in development, created over 3,500 jobs and brought in over $35 million in local, state and federal taxes. While the tax framework envisions repeal of all other business credits, including the historic rehabilitation tax credit, the outline gives discretion to the tax writing committees to decide to retain additional business credits to the extent budget limitations allow. Support for the federal historic rehabilitation tax credit is already gaining momentum in the House thanks to Rep. David McKinley (R - WV, 1). Rep. McKinley is circulating a Dear Colleague letter encouraging other Representatives to support the preservation of the federal historic rehabilitation tax credit. Now is the time to thank Rep. McKinley and ask Representatives Mooney and Jenkins to sign on with their West Virginia Colleague. Learn how below... THE TIME TO ACT IS NOW!The House Ways & Means Committee plans to produce a tax reform bill by the end of October and in the next three weeks it is imperative that you make your VOICE heard NOW! ACTION STEPS: CALL, WRITE, REPEATWrite an Email: The easiest way is to write your Congressman and Senator by sending them a message through their websites. You can use this form letter and cut and paste it into the message system on your Congressman's website (you may have to enter your zip code to authenticate that you are a constituent.) You can find each Representative and Senator's website and other contact information at the link below (for Representative McKinley - tell him thank you for his leadership in preserving the federal historic tax credit).

In your message, tell them the historic tax credit is important to your community and our state. If you have witnessed a preservation project in your community, tell them about it. The National Trust for Historic Preservation has good studies and statistics you can look at as well, but an example you know about is most powerful. Acknowledge that the need for tax reform is clear, but it must not come at the expense of this important economic redevelopment incentive, that more than pays for itself, and has a proven track record of creating jobs, revitalizing neighborhoods and saving historic buildings. To see your Representative and Senator's contact information click here. Call: Use your voice! Pick up the phone and call your congressman’s office and tell them why you support the historic tax credit. Tell them to remember you and your communities when they consider any tax reform. As a constituent your voice is important to your representative! Repeat: Have you emailed and called? Do it again. If you haven’t heard back from your congressman’s office within a few days, call and email again. Encourage your colleagues and fellow community members to do the same; write, call, repeat. The more voices we have telling congress just how impactful the historic tax credit is the better chance we have of getting included in tax reform. Please share your efforts with us and know that we are truly thankful for your efforts on behalf of the historic tax credit. If you have any questions or concerns please contact our office. Thank you! Preservation Alliance of West Virginia REPUBLICAN TAX REFORM FRAMEWORK RELEASED—HISTORIC TAX CREDIT NOT IDENTIFIED AS WORTH KEEPING!9/28/2017

Urge your Congressional delegation to contact members of the House Ways and Means and Senate Finance Committees with the message that repealing the historic tax credit is bad policy. The need for tax reform is clear, but it must not come at the expense of a program that more than pays for itself and has a proven track record of creating jobs, saving historic buildings, and revitalizing neighborhoods.

Now is the time to speak up for the historic tax credit. Join us in letting Washington know that historic preservation advocates need their voices heard. Our history is too important. Good news! On Thursday, February 16th, legislation was introduced in Congress that would make important changes to the historic tax credit. The bipartisan Historic Tax Credit Improvement Act (HTCIA)(H.R. 1158 / S.425) closely resembles legislation introduced in the last Congress that would improve access to the credit for smaller rehabilitation projects that will help revitalize our small towns and our inner cities.

The legislation was introduced in the House of Representatives by Congressmen Mike Kelly (R-PA) and Earl Blumenauer (D-OR) and is supported by 18 cosponsors, including nine Republicans and nine Democrats and eight members of the Ways and Means Committee. Senators Susan Collins (R-ME) and Ben Cardin (D-MD) introduced companion legislation in the Senate and were joined by Senators Cochran (R-MS), Gillibrand (D-NY), Leahy (D-VT), and Wicker (R-MS). The Historic Tax Credit Improvement Act encourages redevelopment of smaller, income-producing properties by:

Please contact your members of Congress and urge them to support the Historic Tax Credit Improvement Act,H.R. 1158 / S.425. Take Action The HTCIA provides Members of Congress with a way to indicate their support for the credit and offers several reform ideas that could be incorporated into a larger tax reform bill. Adding cosponsors to the legislation is a critical step to protecting the historic tax credit during the tax reform process. Urge Members of Congress to co-sponsor the Historic Tax Credit Improvement Act H.R. 1158 / S.425:

Contact district offices of both House and Senate Members and ask to schedule a meeting: To locate the name and phone number of your House Representative go to: http://www.house.gov/representatives/find/ To locate the names and phone number of your Senators go to: http://www.senate.gov/general/contact_information/senators_cfm.cfm?OrderBy=state&Sort=ASC Helpful Tips:

Resources:

o Shaw Sprague ([email protected]) o Renee Kuhlman ([email protected]) Thank you for speaking up in support of the federal historic tax credit! With your ongoing engagement, the historic tax credit will continue to revitalize our communities, stimulate the economy, and preserve our irreplaceable historic buildings. CALL TO ACTION: URGENT ADVOCACY NEEDED, HISTORIC TAX CREDIT IN DANGER OF REPEAL IN TAX REFORM12/12/2016

President-Elect Trump and Speaker Ryan have prioritized moving tax reform legislation in the first one hundred days of the next Congress which begins in January. A tax reform package could move quickly through Congress by way of the budget reconciliation process, which only requires a simple majority for passage in the Senate, instead of the typically needed 60 votes to cut off debate.

Ways and Means Republican Committee members will be meeting on December 14th-15th to agree on big picture elements of tax reform with a goal to have a draft bill to review in early January. We expect tax reform legislation will follow Speaker Ryan’s “A Better Way” blue print, released earlier this year. This document recommends eliminating tax credits and deductions, which would include the Historic Tax Credit (HTC), the New Markets Tax Credit (NMTC) and the Low Income Housing Tax Credit (LIHTC). The Historic Tax Credit is in grave danger of elimination in tax reform. Historic Tax Credit advocacy is urgently needed, both in the near term and throughout 2017. The Historic Tax Credit (HTC) is the most significant federal financial commitment to historic preservation. Over the last 36 years, the credit has created 2.3 million jobs, leveraged $117 billion in investment, and rehabilitated more than 41,250 buildings—all while generating enough in federal revenue to pay for itself. The Historic Tax Credit Coalition, National Trust for Historic Preservation, National Trust Community Investment Corporation and allied organizations, like the Preservation Alliance of WV, are moving quickly to increase lobbying capacity. However, there is no substitute for the advocacy that you can provide. Your assistance is critical! We are hopeful that if a sufficient number of Senators and Representatives convey their support for the HTC to party leadership and to members of the tax writing committees, the Historic Tax Credit can be retained as an important part of a reformed tax code. Requested Action: Contact House Members of Congress ASAP– Call (during office hours) or email the offices of your Members of Congress before December 14th and ask to speak to tax staff or staff contacts you have in offices. Since there are no West Virginia Representatives on the House Committee on Ways and Means, ask that they “Please contact Chairman Kevin Brady and other members of the House Ways and Means Committee to explicitly state your support of the Historic Tax Credit when reviewing draft Tax Reform Bill.” Resources: 1. HTC Fact Sheet and Key Points to share with legislators: 2. HTC Maps a. State and Congressional Maps with Economic Data b. Interactive Mapping Tool developed by Novogradac and Company How to Contact Your Member of Congress To locate the name and phone number of your House Representative or Senators go to:http://www.sos.wv.gov/public-services/contacts/Pages/federaloffices.aspx Alternatively, call the Capitol Switchboard at 202-225-3121 (during office hours) and asked to be connected to your Senators’ or House Member’s DC office. Once connected to the office, you should identify yourself as a constituent, and either asked to be connected with tax staff or ask for the email of tax staff to communicate your advocacy. Then follow-up on your request. Historic Tax Credit Improvement Act This Historic Tax Credit Improvement Act (HTCIA) provides several reform options to enhance the Historic Tax Credit as part of a reformed tax code. While the opportunity to co-sponsor this bill has past, the legislation reflects the reform ideas that have broad political support and could be included in a tax reform package. · The House version of the bill (H.R. 3846) has attracted strong bi-partisan support on the Ways and Means Committee and presently has 53 Members of Congress supporting the bill. · The Senate version of the bill, sponsored by Senator Susan Collins (R-ME) and Senator Ben Cardin (D-MD), introduced last March has 7 bi-partisan co-sponsors. |

News and NotesCategories

All

Archives

May 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: [email protected] Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed