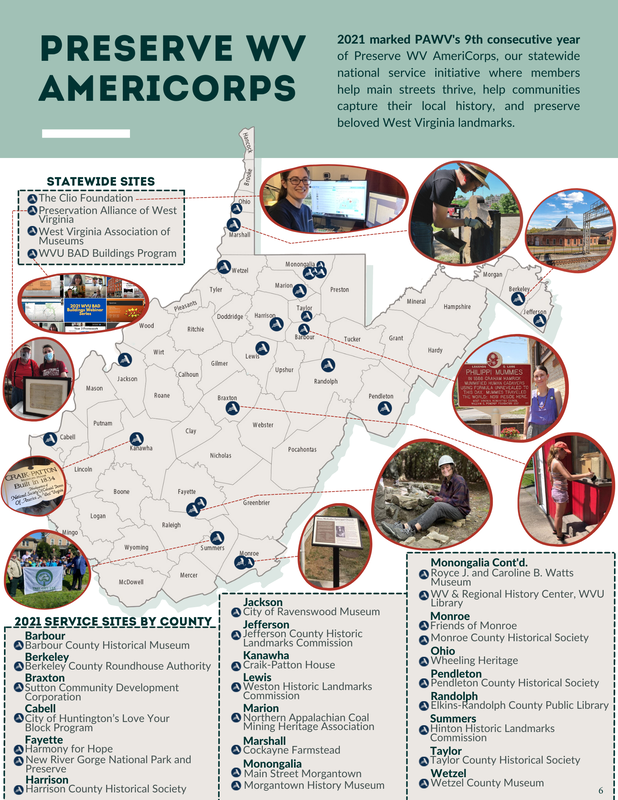

|

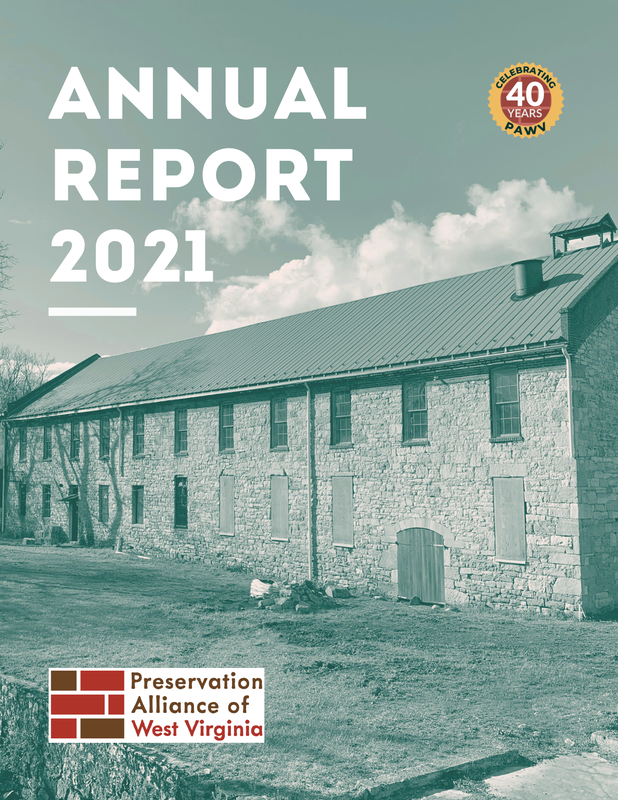

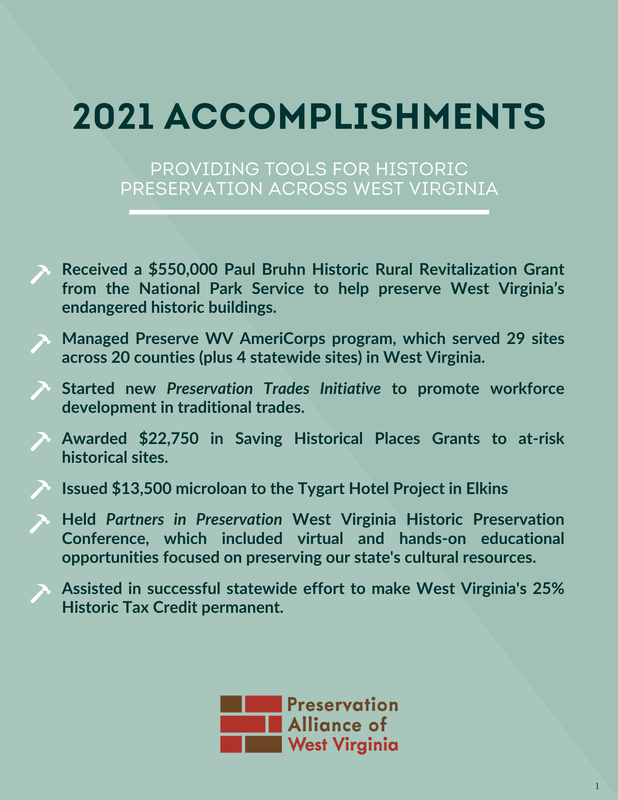

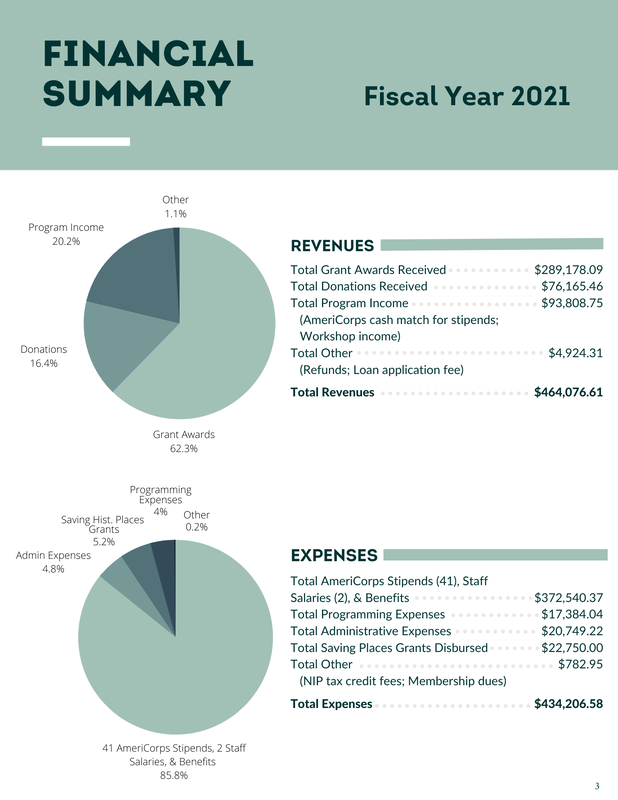

Read the Preservation Alliance of West Virginia's 2021 Annual Report. Check out the .pdf or scroll down to see the report in images.

2 Comments

Come to Virtual Morning Coffee with the Preservation Alliance of West Virginia, the National Trust Community Investment Corporation, and the National Trust for Historic Preservation.

Join us at 9am on Thursday, December 16th, for a news brief where we’ll discuss an opportunity to improve a crucial tool for redeveloping West Virginia’s downtowns and incentivizing the re-use of vacant buildings - the historic tax credit. A total of 122 Federal Historic Tax Credit projects in West Virginia between fiscal year 2001 through 2020 has leveraged an estimated $258,016,381 in total development. During the news brief, we will share a legislative update, how to take action and how potential improvements to the historic tax credit can benefit local community development by maximizing the long-term impact and sustainability of current federal funding opportunities for community projects by incentivizing private sector investment. Register here https://savingplaces-org.zoom.us/meeting/register/tJ0lf-6rrDwsHtUg7nddSrjOJqOE8i9b3ibZ West Virginia has made its historic tax rehabilitation credit program permanent. Gov. Jim Justice recently signed the bi-partisan bill, which provides a 25% tax credit for those who rehabilitate historic income-producing properties. The 25% credit, which became law in 2018, was set to expire at the end of 2022. In those five years, the program attracted renewed interest in West Virginia’s historic commercial districts and spurred private reinvestment in more than 80 vacant and dilapidated buildings throughout the state. In just two of those years, more than $34 million were invested in nine projects. The move to a permanent 25% credit provides needed certainty to property owners and developers, explained Renee Kuhlman, Senior Director at the National Trust for Historic Preservation. The 25% credit often fills a financing gap in a project, but the uncertainty around its future made it difficult for developers to successfully apply for construction loans or plan long-term projects. “The removal of the sunset date increases the attractiveness of the credit to investors,” Kuhlman said. “Already, I’ve received a call from a New Orleans developer wanting information about West Virginia properties because the program was made permanent.” Without this tax credit, many historic redevelopment projects would not happen, explained Danielle Parker, executive director of the Preservation Alliance of West Virginia, a statewide organization dedicated to supporting and promoting historic preservation. The 25% credit is often the reason a project becomes feasible. "There are over 1,000 properties, including 168 historic districts, that can be revitalized using the credit, and I am excited to see how these places can be brought back to life using this financial incentive,” Parker said. The state historic tax credit is capped at $30 million of income tax credits per year. The program also offers a 20% residential rehabilitation credit for historic homes, which is also permanent. The State Historic Tax Credit is administered by the WV Historic Preservation Office, and the National Parks Service. For more information on applying for the credit or to find out if your property is an eligible tax credit project, please call 304-558-0240. You can also Visit the WV Historic Preservation Office's website for additional information. THANK YOU!Thank you to Senator Ryan Weld for being the original sponsor of this legislation and for being a champion of historic preservation and community revitalization for West Virginia!

We want to say thank you to the legislation's co-sponsors too! They are Senators Mike Woelfel, Robert Plymale, Richard Lindsay, Eric Nelson, Stephen Baldwin, Mike Maroney, and Glenn Jeffries. Special thanks to Delegate Erikka Storch for supporting this bill through the House of Delegates and to the Abandoned Properties Coalition for leading the charge to make the 25% state historic tax credit permanent. U.S. Senators Joe Manchin (D-WV), Chairman of the Senate Energy and Natural Resources Committee, and Shelley Moore Capito (R-WV) introduced bipartisan legislation, S. 1258, on Tuesday to extend the authorizations of West Virginia’s National Coal Heritage Area and Wheeling National Heritage Area – which are set to expire September 30, 2021.

“As Chairman of the Senate Energy and Natural Resources Committee, I am well aware of the impacts National Heritage Areas can have on local communities. Extending the authorizations of the National Coal Heritage Area and the Wheeling National Heritage Area will allow us to continue to recognize their significant contributions to our nation and provide an economic boost to the communities around them. This bipartisan legislation will preserve and protect West Virginia’s rich cultural traditions and historic sites so that future generations can enjoy them as we have, and I look forward to it being enacted into law,” said Senator Manchin, Chairman of the Senate Energy and Natural Resources Committee. “Both the Wheeling National Heritage Area and National Coal Heritage Area are important to the culture and scenic beauty of our state. It is essential that we extend their designation as National Heritage Areas to help continue our efforts toward conservation, restoration, and economic development in these regions. I’m proud to introduce legislation that will help boost tourism and revenue in West Virginia, while also helping to expand opportunities for people to enjoy the natural beauty and history that our state has to offer,” Senator Capito said. National Heritage Areas (NHA) are designated by Congress as places where natural, cultural, and historic resources combine to form a cohesive, nationally important landscape. By extending the official NHA designation, the National Coal Heritage Area and Wheeling National Heritage Area can continue to remain eligible for grants and technical assistance from the National Park Service that help create jobs, generate revenue for local governments, and sustain local communities  Pictured here is the Flatiron Building located on Main Street in downtown Wheeling. It had been vacant for years before being totally transformed into loft housing with a first-floor coffee shop. This $2.5 million dollar project qualified for $632,653 in state historic rehabilitation tax credits and created 19 constructions jobs. In 2017, the West Virginia Legislature voted to increase the state historic rehabilitation tax credit from 10% to 25%. However parts of the legislation will affect future reinvestment opportunities and even discontinue the tax credit increase. A network of nonprofit organizations, municipalities, and private investors have joined together to ask the Legislature to address these issues and are asking for support in favor of SB344, which was introduced by Senator Weld (R-1) with Senators Plymale (D-5) and Woelfel (D-5) as co-sponsors. SB344 is a bi-partisan bill that will:

the state historic rehabilitation tax credit works for west virginia!From 2018 to 2021, the historic rehabilitation tax credit has attracted renewed interest in our historic commercial districts and spurred private reinvestment in over 80 vacant and dilapidated buildings (some of which are pictured above). When a vacant or underutilized building is repurposed, it generates additional revenues to local government through increased property taxes. Once the state's initial investment is recouped, the project continues to yield positive economic impacts through a combination of sales, income, and business taxes. In 2018 & 2019, over $34 million dollars were invested to finish 9 projects in Charleston, Clarksburg, Fairmont, Franklin, Huntington, Spencer, and Wheeling. These projects created 256 construction jobs for West Virginia. Rehabilitation projects support higher labor costs for construction jobs rather than new materials and also utilize in-state trades and professional services such as legal, accounting, architectural, and engineering, as well as wholesale trade and retail trade. Large and small-scale developers report that historic rehabilitation tax credit programs fill a critical financing gap. The 25% rate provides an incentive to make a difference in a developer's decision to undertake a rehabilitation project, and it makes projects more feasible for individuals. How Does the tax credit work?When rehabbing a certified historic building for a commercial purpose, owners apply for tax credits through the WV State Historic Preservation Office. A building is considered a certified historic structure when it is either individually listed on the National Register of Historic Places or contributing within a historic district. The state historic rehabilitation tax credit is a dollar-for-dollar reduction in income tax liability and can only be applied to the owner's annual income after a rehabilitation project is complete. State and local governments benefit from an increase in employment and other tax revenue even before the tax credit is claimed. Learn more about what you can do to help.

National Heritage Area designation for Appalachian Forest National Heritage Area became official with the President’s signing on March 12 of S.47, the John D. Dingell, Jr. Conservation, Management, and Recreation Act, the also known as the Natural Resources Management Act.

The Bill also included a wide variety of designations and land management bills from across the country, including the Sportsman Act and permanent reauthorization of the Land and Water Conservation Fund. The bipartisan bill passed in the Senate on February 12, and in the House on February 26, by overwhelming majorities. Sen. Joe Manchin, sponsor of the original Appalachian Forest National Heritage Area Act, and a co‐ sponsor of the Senate Natural Resources Management Act, said “The Appalachian Forest Heritage Area is a treasure that has done a great deal for West Virginia. This national designation is long overdue.” The Appalachian Forest designation bill was also co‐sponsored in the Senate by Sen. Shelley Moore Capito, Sen. Ben Cardin, and Sen. Chris Van Hollen. The companion House bill is sponsored by Rep. David McKinley, with co‐sponsors in the previous session from Rep. Evan Jenkins, Rep. John Delaney, and Rep. Alex Mooney, and in the current session adding co‐ sponsors Rep. Carol Miller and Rep. David Trone. “Creating an Appalachian Forest National Heritage Area will allow us to continue to celebrate and promote the beauty of our state, preserve our heritage and plan for the future,” Rep. McKinley said of the legislation. “National Heritage Areas deliver a significant economic return and helps us showcase the sometimes‐hidden gems of our cultural heritage.” “We are incredibly excited to be finally receiving National Heritage Area designation for the Appalachian Forest,” said Phyllis Baxter, Executive Director of Appalachian Forest Heritage Area, Inc, the coordinating entity for the newly designated area. “We have been working on this for fifteen years, and are so pleased to now be nationally recognized. This designation will increase our visibility to attract tourism, and increase our capacity to help local communities.” National Heritage Areas are designated by Congress as places where natural, cultural, and historic resources combine to form a cohesive, nationally important landscape. With the official national heritage area designation the Appalachian Forest National Heritage Area can earn recognition as being nationally significant, and will have access to National Park Service technical assistance and funding to provide more services to the region. The Appalachian Forest Heritage Area works in 16 counties of West Virginia and 2 counties of western Maryland on conservation, forestry, cultural heritage, tourism and community development. With the overall theme of forest heritage, the initiative works with willing partners to explore and enhance the relationship between the forested mountains and the people who live here. For more information see www.appalachianforest.us, email [email protected], or call 304‐636‐ 6182. U.S. Sen. Joe Manchin, D-W.Va., is praising federal legislative action this week for protecting the Appalachian Forest Heritage Area, which is part of 18 counties including Randolph County.

Manchin, a ranking member of the Senate Energy and Natural Resources Committee, secured the permanent reauthorization of the Land and Water Conservation Fund, the national designation of the Appalachian Forest Heritage Area and an increase in the funding cap for the Wheeling National Heritage Area as part of the Natural Resources Management Act. “I’m proud to have worked with my colleagues on both sides of the aisle to finally permanently reauthorize LWCF so our land management agencies can operate fully and without the fear of losing access to the funding they rely on. The Appalachian Forest Heritage Area is a treasure in Randolph County and this national designation is long overdue,” Manchin added. “By reauthorizing the Land and Water Conservation Fund, this bill supports West Virginia’s heritage and outdoor recreation economy and keeps faith with the important idea that America’s outdoors and public lands are part of who we are as a nation,” said Angie Rosser, executive director of West Virginia Rivers. LWCF is a conservation tool that ensures states and federal public land management agencies are able to protect and conserve our natural resources without relying on taxpayer dollars. In West Virginia, LWCF funded the acquisitions of the Gauley River National Recreation Area, New River Gorge National River and Dolly Sods. Since 1965, more than $243 million in LWCF funds have been spent in West Virginia on more than 500 projects, both on state and federal lands. This includes improvements to local parks and public spaces in 54 of West Virginia’s 55 counties. To read the full article, visit the Intermountain's website at www.theintermountain.com/news/local-news/2019/02/forest-heritage-area-receives-designation/?fbclid=IwAR1sTMTTTLEegcPCRiZrjqIitSA2InvF1267CLT4wF1MFTAPznAV8dW4BKA Urgent Action Requested! The federal historic tax credit reduced in Senate Tax Reform Bill Release, House Committee Passes Tax Bill with HTC Eliminated Today the Senate Finance Committee released their version of a tax reform bill that reduces the Historic Tax Credit in half, from 20% to 10% for historic buildings. Additionally, the 10% pre-1936 non-historic “old” building credit is eliminated. Also today, the House Ways and Means Committee passed The Tax Cuts and Jobs Act (TCJA) or H.R. 1, with the HTC entirely eliminated, on a party line vote 24-16, setting up full-House floor consideration next week. Your immediate ACTION is needed! Advocacy Resources

How Can You Take Action? Contact House and Senate Members - Call (during office hours) the offices of your Members of Congress. Ask to speak to tax staff, your staff contacts in offices or ask for email addresses of tax staff. A suggested outline of your email message or phone call:

All advocates should be fully activated across the country, connecting with both House and Senate offices, asking them to retain the HTC in tax reform bills, undiminished. The fate of the HTC will be determined over the next few weeks, please advocate and ask others to advocate!

The House of Representatives is expected to consider and vote on the bill on the House floor next week. Also next week, the Senate will begin to mark-up and pass their version of the tax reform bill out of the Senate Finance Committee. -Please contact your House Representative by COB Monday and ask them to work with House leadership to insert the HTC back into the final House bill. -Contact your Senators by COB Monday and ask them to go to the Senate Finance Committee and Senate leadership, express support to retain the HTC in the Senate tax reform bill undiminished. Despite our collective frustrations, it is extremely important to keep all Capitol Hill communication constructive and respectful. Advocates Should Focus on Preserving the HTC not influencing the Transition Rules While the House repeal transition rules have been described as both stingy and unclear, advocates should direct 100% of their advocacy to preserving the credit in its current form in the House and Senate. Should the need arise, there will be opportunities later in the legislative process to negotiate favorable transition rules. Now is not that time. Such actions could extinguish momentum advocates are gaining to retain the HTC in tax reform. There is a good chance the Senate bill passed out of committee will incorporate the historic tax credit and there is still opportunity for the HTC to be added back in the House bill.

U.S. Representatives Evan Jenkins, R-W.Va., and David McKinley, R-W.Va., have been outspoken in their support for the credits, she said.

"We are grateful that McKinley and Jenkins requested the inclusion of this economic-development tool in the tax reform bill," LaPresta said. "Both legislators represent districts in which historic tax credits are attracting private investment." Historic tax credits helped finance 92 commercial-rehabilitation projects in West Virginia between 2002 and 2016, leveraging more than $175 million in development investment and supporting more than 3,500 construction jobs, she said. "These credits are highly influential when it comes to attracting larger businesses into West Virginia downtowns," LaPresta said. The tax credit was championed by President Ronald Reagan to encourage the rehabilitation of abandoned and underutilized properties. Since 1981, it has leveraged more than $131 billion in private investment and created more than 2.4 million, she said. The state Legislature in October increased the State Historic Tax Credit from 10 to 25 percent, but weakening or eliminating the Federal Historic Tax Credit could endanger the feasibility of nearly all historic rehabilitation projects in West Virginia. "We think the credit complements, rather than hinders, Congress's goal of pro-growth tax reform," LaPresta said. “There are a dozen buildings that we predicted would be rehabilitated with the increase of the state historic tax credit. Now, with the proposed elimination of the federal credit, we fear progress will be jeopardized." The Preservation Alliance of West Virginia is a non-profit dedicated to historic preservation and a statewide partner in the National Trust for Historic Preservation. LaPresta is urging business leaders who wish to advocate for the federal historic tax credit to contact the alliance at 304-345-6005 or visit its website at PAWV.org. MEDIA CONTACT Danielle LaPresta Executive Director Preservation Alliance of West Virginia www.pawv.org [email protected] 304-345-6005 The West Virginia House of Delegates and State Senate, during this week’s special session of the Legislature, passed House Bill 203 to increase the State Historic Tax Credit from 10 percent to 25 percent.

Gov. Jim Justice placed the bill on the Special Session agenda after consultation with legislative leadership and interested parties. The Preservation Alliance of West Virginia, Abandoned Properties Coalition, US Green Building Council, W.Va. Chapter, W.Va. Community Development Hub, Wheeling Heritage, private developers, citizens, and municipalities joined together to create the Revitalize West Virginia Downtown Coalition. That coalition developed a plan to increase the state historic tax credit to aid in economic development of the state and educate legislators on the importance of the historic rehabilitation tax credit. Danielle LaPresta, executive director of the Preservation Alliance of West Virginia, said, “I am pleased that the Governor and legislature saw the potential of the historic tax credit to serve as a catalyst to revitalize West Virginia. This program will spark economic development throughout the state regardless of the size of the community.” The governor is a strong ally of historic preservation in West Virginia, LaPresta said. The 25 percent credit brings West Virginia to parity with neighboring states. Ohio, Pennsylvania and Virginia have a 25 percent state historic tax credit; Maryland and Kentucky have a 20 percent tax credit. This increase will encourage the rehabilitation of historic buildings and spur private investment, create jobs, and help rid the state of vacant and underutilized buildings. Studies have shown that the estimated return on the state’s investment is approximately 2:1. This means for every dollar of tax credit provided by the state, two dollars of additional state taxes and revenue will be created through investments. Renee Kuhlman, director of Policy Outreach, Government Relations and Policy from the National Trust for Historic Preservation said, “With these improvements, state legislators are putting West Virginia’s heritage to work and encouraging investors to bring their dollars to the Mountaineer State. States that have improved their historic tax credits have doubled the use of the federal historic tax credit and have seen construction jobs increase because renovation is labor intensive.” The Legislature passed the legislation with overwhelming support in both houses. Mike Gioulis, PAWV Advocacy chairperson, speaking for the coalition, said: “The coalition would like to thank all of the legislators that voted in favor of the bill, including the sponsors, Speaker Tim Armstead, R, Kanawha, and Tim Miley, D, Harrison. We appreciate that Senate Majority Leader Ryan Ferns, R, Ohio, and Senator Glenn Jeffries, D, Putnam, spoke in favor of the bill. We also would like to thank Chairman Eric Nelson, Jr., R, Kanawha, for his leadership on this issue.” The group also values the support and leadership of Justice as well as his staff. The West Virginia State Historic Preservation Office is developing standards and procedures to educate and promote the program to the public. For more information relating to the historic tax credit program, contact Jennifer Brennan, State Historic Tax Credit Coordinator at 304-558-0240. For additional information regarding this effort, contact the Preservation Alliance of WV Advocacy Chairman Mike Gioulis at 304-545-4881, or visit www.pawv.org and www.revitalizewvdowntowns.com. |

News and NotesCategories

All

Archives

May 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: [email protected] Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed