|

By Joselyn King / The Intelligencer

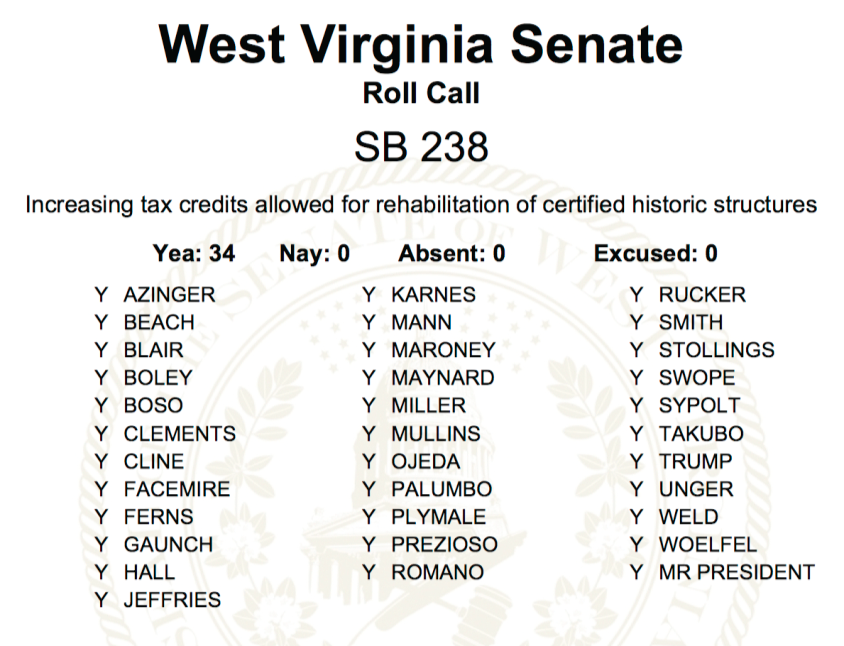

WHEELING — The West Virginia House of Delegates passed its version of a revenue bill Friday on what was the sixth day of a special legislative session in Charleston called for setting the state’s 2018 budget. Despite a long agenda of proposed amendments, House Bill 107 was approved with few changes from the measure passed Thursday by the House Finance Committee. It would maintain West Virginia’s consumer sales tax at 6 percent, but would eliminate sales tax exemptions on cellphone services. It also would make no changes to the state’s coal and gas severance tax rates, but would gradually eliminate all taxation of Social Security within the next three years. Read the full story, including more about the historic tax credit, at theintelligencer.net.

0 Comments

By Ashton Marra / WV Public Broadcasting

Members of the House are standing their ground when it comes to tax reform. At least, that’s what House Speaker Tim Armstead said Friday after a vote in the chamber on its own version of a revenue bill. The bill does not include any of the changes to the personal income tax Senate Republicans and Gov. Jim Justice have agreed to, but Armstead said that doesn’t mean his chamber isn’t still willing to work on a compromise. Members of the House voted 74 to 17 in favor of the tax bill negotiated between House Democrats and Republicans. It brings in an estimated $100 million in additional revenue to close a budget gap in the 2018 fiscal year, which isn’t enough according to members of the chamber, but is a start. Read the full story, including more about the historic tax credit, at wvpublic.org. Although the main order of business is to pass a budget, Governor Jim Justice has made it a priority to also include increasing the state’s historic tax credit to the agenda, and we’re really excited about it.

Increasing the state’s historic tax credit to 25 percent will help spark new development in West Virginia’s historic downtowns. As the statewide organization dedicated to attracting and retaining young people in the Mountain State, we know that quality of place is a driving factor for young people in choosing where they want to live and work. Young people want to be where the action is and an increase in historic tax credit will help West Virginia build walkable, vibrant communities that are especially attractive to the next generation. Check out the special session update from Generation West Virginia. After receiving widespread bipartisan support during the regular session, historic tax credit legislation ultimately failed on the final day of regular session. But now we have another chance to increase the state’s historic tax credit, and we need your help to do it. If revitalizing your downtown is a priority to you, let your representatives know by clicking here.

In President Trump’s FY2018 budget, he proposes to eliminate funding for the National Heritage Areas. The 49 National Heritage Areas across the country – two of which are in West Virginia (Wheeling and Coal) – preserve and revitalize cultural, historic and natural resources, delivering recreational and educational opportunities to visitors, residents and entire regions. Through innovative public-private partnerships, National Heritage Areas have effectively leveraged federal resources, attracting an average of $5.50 of private funding for each dollar appropriated.

Heritage Areas have a proven record of fostering job creation and advancing economic, cultural, historic, natural, and community development. In addition to creating jobs, National Heritage Areas generate valuable revenue for local governments and sustain communities through revitalization and heritage tourism. Lastly, Heritage Areas have undergone rigorous independent evaluations by the National Park Service which document the program’s worth. Please join PAWV in calling your Congressmen by March 24 and request that they ask appropriators provide robust funding for the National Heritage Area program in the FY 18 budget. Robust funding for this critical initiative will enable communities and regions to effectively tell the stories of their past for the benefit of present and future generations. District 1 – Congressman David McKinley – (202) 225-4172 District 2 – Congressman Alex Mooney – (202) 225-2711 District 3 – Congressman Evan Jenkins – (202) 225-3452 You can also encourage your Congressman to co-sponsor HR 1002 – National Heritage Area Program Bill, which would establish a designated program for National Heritage Areas within the National Park Service, including clear criteria for designation and evaluation. According to the bill sponsors, Congressmen Charles Dent (R-PA) & Paul Tonko (D-NY), “National Heritage Areas are considered one of the Department of the Interior’s most cost effective initiatives, relying on a public/private partnership in which every federal dollar is matched with an average of $5.50 in other public and private financing.” In Governor Justice’s FY2018 Recommended Budget (SB 199 and HB 2018) all Division of Culture & History programming that comes from the state Lottery Education Fund (fund 3534 in the budget) will be eliminated. Programs that are made possible through the state Lottery Education Fund include the following appropriations (numbers reference line items in the budget):

Defunding these will cause a major detriment to economic development and cultural heritage tourism in West Virginia. What you can do to help? Currently the Senate Finance Committee and House Finance Committee are working on their own FY2018 budget proposals. Contact committee members and ask them to include funding for these line items in their budget proposals. You can find the contact information for the Senate Finance Committee members at http://www.legis.state.wv.us/committees/senate/SenateCommittee.cfm?Chart=fin and House Finance Committee members at http://www.legis.state.wv.us/committees/house/HouseCommittee.cfm?Chart=fin When you contact committee members, you can ask them to fully fund the Division of Culture & History. Offer specific information about what will be lost without this funding. Historic Preservation Grants keep roofs on historic buildings. Private, government, and nonprofit historic building owners can apply for these grants. All properties listed individually on the National Register of Historic Places and listed as a contributing building in a National Register Historic District are eligible. Every dollar in grants leverages an equivalent dollar amount in private and personal funds. These grants can be combined with tax credit incentives, as well. Arts Programming supports activities around the state like the Huntington Symphony, WV Public Theater, and local community arts activities, as well as Festivals from Vandalia Gathering and Appalachian String Band Festival at Clifftop, to Mountain State Forest Festival and fairs in small communities, would all lose funding through the Governor’s recommended budget. These programs utilize state funds to leverage federal, community and private dollars for programs that support jobs, bring visitors to WV tourism destinations, and enhance quality of life that attracts new business. If you want to protect arts and historic preservation funding, please contact Finance Committee members today and ask them to fully fund the Division of Culture & History. Good news! On Thursday, February 16th, legislation was introduced in Congress that would make important changes to the historic tax credit. The bipartisan Historic Tax Credit Improvement Act (HTCIA)(H.R. 1158 / S.425) closely resembles legislation introduced in the last Congress that would improve access to the credit for smaller rehabilitation projects that will help revitalize our small towns and our inner cities.

The legislation was introduced in the House of Representatives by Congressmen Mike Kelly (R-PA) and Earl Blumenauer (D-OR) and is supported by 18 cosponsors, including nine Republicans and nine Democrats and eight members of the Ways and Means Committee. Senators Susan Collins (R-ME) and Ben Cardin (D-MD) introduced companion legislation in the Senate and were joined by Senators Cochran (R-MS), Gillibrand (D-NY), Leahy (D-VT), and Wicker (R-MS). The Historic Tax Credit Improvement Act encourages redevelopment of smaller, income-producing properties by:

Please contact your members of Congress and urge them to support the Historic Tax Credit Improvement Act,H.R. 1158 / S.425. Take Action The HTCIA provides Members of Congress with a way to indicate their support for the credit and offers several reform ideas that could be incorporated into a larger tax reform bill. Adding cosponsors to the legislation is a critical step to protecting the historic tax credit during the tax reform process. Urge Members of Congress to co-sponsor the Historic Tax Credit Improvement Act H.R. 1158 / S.425:

Contact district offices of both House and Senate Members and ask to schedule a meeting: To locate the name and phone number of your House Representative go to: http://www.house.gov/representatives/find/ To locate the names and phone number of your Senators go to: http://www.senate.gov/general/contact_information/senators_cfm.cfm?OrderBy=state&Sort=ASC Helpful Tips:

Resources:

o Shaw Sprague (ssprague@savingplaces.org) o Renee Kuhlman (rkuhlman@savingplaces.org) Thank you for speaking up in support of the federal historic tax credit! With your ongoing engagement, the historic tax credit will continue to revitalize our communities, stimulate the economy, and preserve our irreplaceable historic buildings. Appalachian Forest Heritage Area is one step closer to national recognition, thanks to the introduction in the Senate of the S. 401 Appalachian Forest National Heritage Area Act of 2017. Introduced by U.S Senators Joe Manchin (D-W.Va.), Shelley Moore Capito (R-W.Va.), Ben Cardin (D-Md.) and Chris Van Hollen (D-Md.), the bill would designate the 18 county region in the highlands of West Virginia and western Maryland as a National Heritage Area.

“We are incredibly excited to have our designation bill introduced in the Senate this early in the Congressional session,” said Phyllis Baxter, Executive Director of Appalachian Forest Heritage Area. “We thank all four of our Senators for their support and look forward to movement on our bill as the session progresses.” Appalachian Forest Heritage Area (AFHA) has been seeking National Heritage Area designation since approval of their Feasibility Study by the National Park Service in 2006. Designation as a National Heritage Area will bring national recognition of the importance of the Appalachian Forest Heritage story, as well as technical assistance through the National Park Service and funding for local projects. AFHA works only with willing partners, and designation as a National Heritage Area does not change any land management and does not add any new regulations. Appalachian Forest Heritage Area (AFHA) has been working for over 15 years to promote rural community development through heritage tourism and forest conservation. As a heritage area, AFHA works across county and state lines with communities, agencies and non-profit groups. AFHA builds partnerships with a wide variety of interest groups, including forest industry, public lands agencies, and environmental groups, historic and cultural sites, and tourism and community development efforts. Recent accomplishments include the Appalachian Forest Discovery Center in downtown Elkins, new on-line thematic story map tours, and conservation awareness outreach. AFHA sponsors a 38 member AmeriCorps program which provides assistance to local site partners on conservation, community development, heritage tourism, and historic preservation projects. For more information about Appalachian Forest Heritage Area, see www.appalachianforest.us , call 304-636-6182 or email afha@appalachianforest.us. For the Senate press release, see https://www.capito.senate.gov/news/press-releases/capito-manchin-cardin-van-hollen-introduction-legislation-to-designate-appalachian-forest-heritage-area

West Virginia has 92 commercial and mixed-use historic districts ripe for revitalization – yet developers choose to invest in neighboring states instead of our downtowns due to West Virginia’s uncompetitive 10% historic rehabilitation tax credit. Neighboring states, including Pennsylvania, Ohio, and Virginia, all have 25% historic rehabilitation tax credits. Since 2002, each of these three states has created more than 44,000 jobs in the redevelopment of historic buildings, generating more than $3 billion in total income for each state. In the same period, West Virginia’s 10% tax credit has created just 3,529 jobs, and $170 million in total income.

The state must take action to remain economically competitive with surrounding states. An increase in the current state historic rehabilitation tax credit from 10% to 25% would make West Virginia’s historic commercial districts more attractive to developers, spurring private investment. There are a number of ways you can support the proposal to encourage redevelopment of West Virginia’s historic building, you can contact your state legislators and sign a petition. Learn more by visiting https://revitalizewvdowntowns.com. The coalition’s members include the Abandoned Property Coalition, the American Institute of Architects WV Chapter, the National Trust for Historic Preservation, Wheeling National Heritage Area, and private businesses. If your organization is interested in joining the coalition, contact PAWV at dlapresta@pawv.org to learn how. |

News and NotesCategories

All

Archives

January 2024

Subscribe to our mailing list to receive e-news updates on historic preservation news and events in West Virginia.

|

Get Involved |

Programs |

Contact UsPreservation Alliance of West Virginia

421 Davis Avenue, #4 | Elkins, WV 26241 Email: info@pawv.org Phone: 304-345-6005 |

Organizational Partners:

© COPYRIGHT 2022 - PRESERVATION ALLIANCE OF WEST VIRGINIA. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed